Can I Claim For Working From Home During Covid 19

This information is written in a way that is easy to read. Only required to work from home part-time.

Working From Home Tax Deductions Covid 19

The good news is that the South African Revenue Service SARS will let you claim tax back on these costs.

Can i claim for working from home during covid 19. Below we discuss what expenses qualify and how you can claim. The employer must allow the employee to work from home. Evies total work from home claim for March June 69396.

It is about a simple way to claim a deduction if you worked from home during March 2020 to June 2021 because of COVID-19 coronavirus. Duyen ends up working from home for five days per week until 30 June 2020 as a result of COVID-19. However employers may not want you to keep all your leave until later in the year.

Claiming back working from home expenses can be done online Image. You may be eligible to claim back expenses if you are remote working. You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

This includes if you have to work from home. Many offices and places of work have been reopening and closing and reopening but to ensure they are Covid safe fewer employees can go into the premises at any one time. Evie can claim 50 of her 80 monthly internet bill x 4 months 160.

If you have been asked to work from home because of the COVID-19 emergency you may be able to claim tax relief against the cost of home expenses. Those who work at home on a voluntary ad-hoc basis would be ineligible to claim. Therefore in this case.

Annual leave during COVID-19 You continue to build up your annual leave when you are working from home and working your usual hours. These are pretty straightforward. Dave Walsh who leads the tax services branch at BDO Canada says anyone who has shifted to working from home during the pandemic should document their expenses and plan to claim them next year.

Ontarians working from home this spring due to COVID-19 could be in for a break next tax season if they take the time to claim home office expenses. COVID-19 and working from home The COVID-19 emergency has had a big impact on working life in Ireland. The COVID-19 pandemic lockdown has led to many South Africans working from home.

Organisations are asking staff where possible to work from home to prevent the spread of the virus. You may not want to take annual leave during the COVID-19 restrictions as your travel options are limited. A registered tax professional.

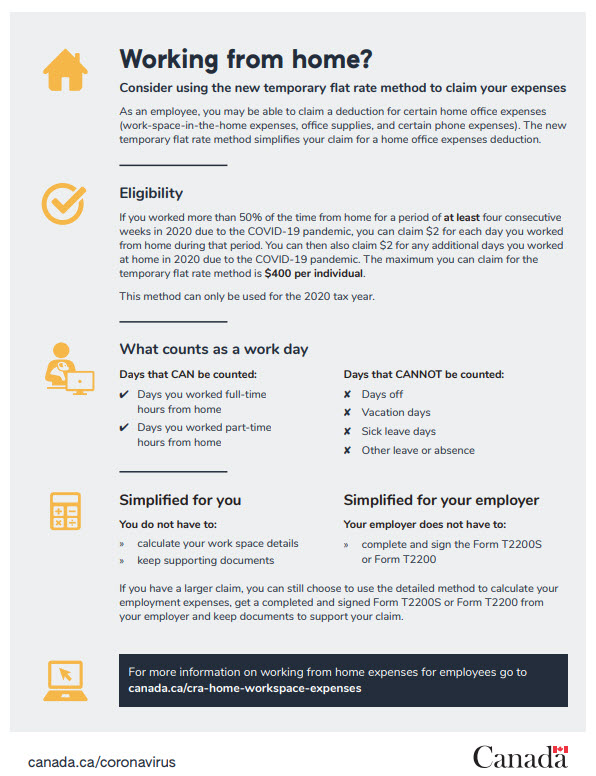

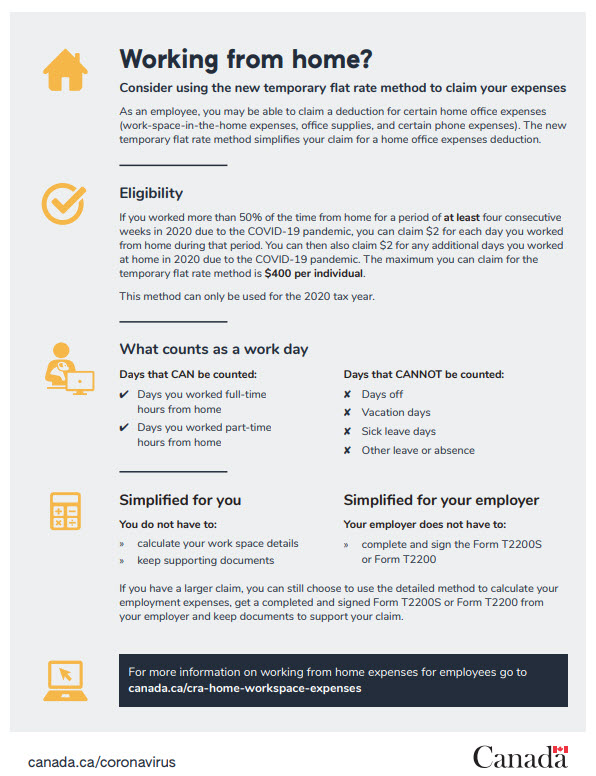

Nearly all of the income tax focus in the context of working from home during COVID-19 has been on claiming running expenses things like electricity heating and internetbroadband fees. On Nov 30th 2020 the CRA announced a new temporary flat rate method for calculating home office expenses that allows Canadians working from home due to COVID-19 to claim a deduction of up to 400. We at TurboTax want to ensure you have all of the information you need to make a claim.

Significantly the notice permits employees as defined to submit claims in terms of COIDA if the employee contracted Covid-19 arising out of and in the course of his or her employment. As Duyen is working from home she can rely on PCG 20203 to claim her additional running expenses for the period from 1 March 2020. Normally claims for tax relief for unreimbursed home-working expenses would only be eligible for tax relief from HMRC if a staff member worked from home on a regular basis under a formal arrangement agreed by the University ie.

Evie can claim 38 hours per week x 80c x 16 weeks 48640. The employee must have an area of. Often this is done by allowing different employees to come in on different days and stay at home on the rest.

17 Dec 2020 QC 63194. The federal government continues to support working Canadians during the COVID-19 pandemic. Eligible employees are able to deduct up to 2 for each day they worked from home in 2020 due to COVID-19 up to a maximum of 400 without having to provide any special forms or documentation to.

With the economy being reopened and scores of people returning to work during the coronavirus surge an imperative question is whether one can be compensated for contracting Covid-19. You can still claim. Shortcut method the new 80c method.

Evie cant claim phone or internet as its included in the 80c per hour rate. Unfortunately most employees working from home cant claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic says. Using a home office often means that you have extra expenses every month.

The employee must spend more than half of their total working hours working from their home office.

Working From Home Can You Claim The Home Office Deduction On Your 2020 Tax Return Kiplinger

Working From Home During Covid 19 These Accountants Have Tax Tips Cbc News

Can You Claim The Home Office Tax Deduction If You Ve Been Working Remotely Here S Who Qualifies Marketwatch

Do S And Don Ts For Claiming Your Working From Home Expenses During Covid 19 Go Study Australia

2020 Income Tax What You Can T And Can Claim For Your Work From Home Office During The Covid 19 Pandemic Moneysense

Working From Home 2020 Tax Information University Of Victoria

I Ve Been Working At Home During The Pandemic Do I Qualify For Home Office Tax Deductions Marketwatch

Working From Home Due To Covid 19 It Could Boost Your Tax Refund

Claiming Working From Home Tax Expenses During Covid 19

I Work Remotely During Covid 19 Can I Take A Home Office Tax Deduction Rkl Llp

Posting Komentar untuk "Can I Claim For Working From Home During Covid 19"