Can I Withdraw Money From Epf Account 1

It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions.

Epf Online Withdrawal Here Are Some Easy Steps To Withdraw Money From Your Account Information News

The money can be withdrawn only after retirement.

Can i withdraw money from epf account 1. Upon a person becoming disable or in the event of death. EPF is a long-term retirement savings scheme. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Think carefully before you withdraw. They can start to withdraw the money from next month to help them deal with the. The EPF i-Sinar allows all affected members to access and withdraw savings from account 1 over six months.

Mikhail Davidovich gettyimages More than 8 million members will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. Information is for general reference only is an unofficial summary based on EPFs official website.

As EPF is a long-term savings scheme you can withdraw the full amount only after retirement. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. The Pros and Cons Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account.

EPF has not provided details on how and when the money should be replaced or what happens if you cant or dont put it back. EPF Withdrawals for Housing. Bank account number and IFSC approved.

You can withdraw money from your old PF account but keep in mind only EPF balance can be withdrawn. Yes a person can withdraw money from hisher EPF account under these condition. Partial withdrawal from EPF accounts is permitted in the case of an emergency such as medical emergency house purchase or construction and higher education.

EPS contribution can only be recovered as monthly pension. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. EPF Withdrawal before 5 years of Service.

PF Accounts for which no contribution has been made for the last 3 years will go into inoperative mode Interest will be credited only for 3 years after which no interest would be paid or under some special circumstances Members Death or amount not withdrawn InOperative PF HelpDesk. Some two million eligible contributors can now withdraw between RM9000 and RM60000 from Account 1 in the Employees Provident Fund EPF under i-Sinar. The government approved withdrawal from Account 1 of the Employees Provident Fund EPF up to RM10000 for those who have lost their jobs or suffered pay cuts this year.

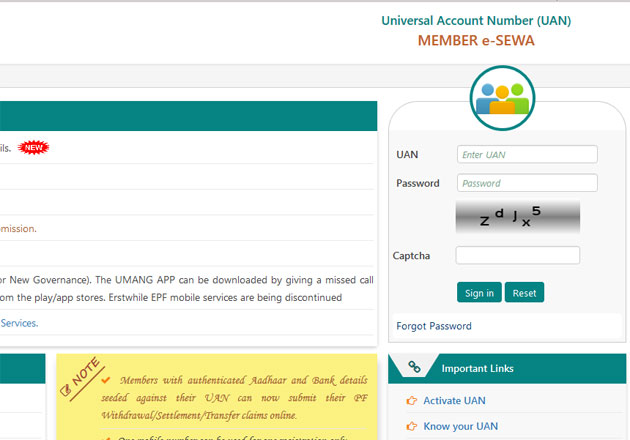

To withdraw EPF from old UAN you need to have your KYC approved. There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2. In such cases you can claim for partial withdrawal in online.

Finance Minister Tengku Zafrul Aziz made the announcement in Parliament today stating that EPF members can apply to withdraw their funds online or visit any EPF office. Here are the main amendments to EPF withdrawal rules-90 of the EPF balance can be withdrawn after the age of 54 years. All EPF Members Can Now Withdraw From Account 1 The government will allow all Employees Provident Fund EPF contributors to withdraw up to RM10000 from their EPF Account 1 through i-Sinar said Finance Minister Tengku Zafrul Aziz said in Dewan Rakyat today.

EPF Account 1 Withdrawal i-Sinar. Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals. Money from the EPF account cannot be withdrawn during employment unlike a bank account.

EPFO Provides a facility for the subscribers to settle. A civil servant placed under the pension scheme. EPF said earlier that if you take out savings from your Account 1 under i-Sinar youll have to put it back later.

When a person migrate to another country. Additional forms documents required. If a person withdraws the amount before 5 years of enrolment then 10 TDS is.

You can withdraw partial amount from your EPF account only for specific reasons such as medical emergency marriage housing and higher education. The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals. When you reach a certain age owning your own home will be high on your list of things to do.

Rules To Withdraw Money From Epf Account Latest News Videos Photos About Rules To Withdraw Money From Epf Account The Economic Times Page 1

Epf Withdrawal How To Check Change Bank Account Details In Your Epf Account The Economic Times

Epf Withdrawal For Covid 19 Online Have Rs 2 00 000 In Pf Account Check How Much You Can Withdraw For Coronavirus Covid Pf Withdrawal Status Timeline Process The Financial Express

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Pf News Want To Withdraw Money From Your Epf Account Online Here S A Step By Step Guide

Epfo Withdrawal A Step By Step Guide To Take Out Second Covid 19 Advance From Your Pf Account Information News

Epf How To Withdraw Money From Your Account Online Ndtv Gadgets 360

Epf Withdrawal Step By Step Guide To Withdraw Money Online Information News

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Posting Komentar untuk "Can I Withdraw Money From Epf Account 1"