Can I Withdraw My Kwsp

50 Can withdraw ALL in Account 2 only. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends.

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

A member can withdraw the full amount from their Akaun 2 when they turn 50.

Can i withdraw my kwsp. You can walk in to any KWSP office to submit the KWSP 9C AHL D8 Withdrawal Form along with the supporting documents or submit via postal services. You can apply for withdrawal through i-Akaun. Members can now withdraw up to RM10000 if they have less than RM90000 in Account 1.

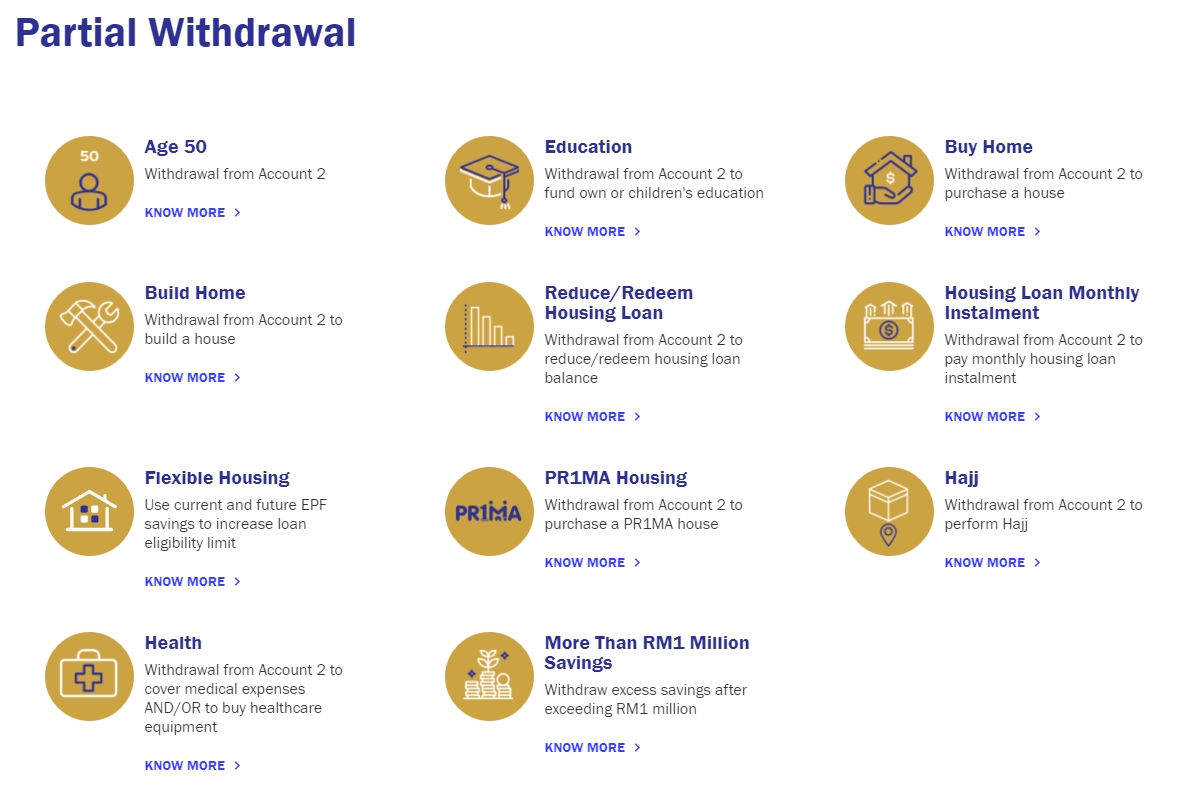

The EPF is not like a bank said the EPFs head of its corporate communications unit Nik Affendi Jaafar. In theory 30 of total Amount for those not who has not withdrawn before 55 Can withdrawal ALL. Withdrawals are allowed BEFORE 50 at Account 2 ONLY for housing loans installments buy new house 1st house settle partial housing loans education medical.

2nd visit did it on Sun super crowded took almost 2 hrs just to get the Q number and. Hope the above helps. Then you need to activate your account within 30 days via wwwkwspgovmy by logging in as members.

Please DO NOT refer to the submission information in Employees Provident Fund KWSP website. For more information regarding the i-Citra programme you can head to the i-Citra FAQ page here. You can keep your EPF savings until 75.

The EPF assures members that no such steps on raising the withdrawal age have been discussed with any party at this point in time. 3 Days later Malaysia Movement Control Order. FULL WITHDRAWAL AT AGE 55 REMAINS takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65.

A Bernama report in todays Sun2Surf and other newspapers says that all contributors to the Employees Provident Fund EPF should withdraw their savings upon reaching the age of 75. Need 2 visits as first visit they only allow to update personal particular passport no update took a week plus and cant submit withdrawal application at the same time - although KWSP main hotline said can. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at.

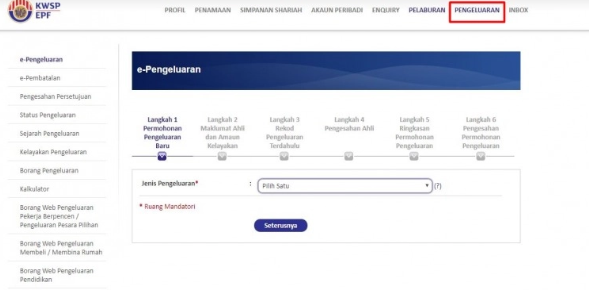

30 May 2020 Passport number updated. You can check through their app or KWSP website. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Applications can be made from 15th July 2021 on this link icitrakwspgovmy. Facebook Messenger Twitter WhatsApp Email Print. Receipt 1 Account Update.

The entire housing loan balance. Icitrakwspgovmy from 15 July 2021 with the first payment expected to be credited in the members account in August 2021. If you do not have an account you may need to first get yourself registered with one at your nearest EPF kiosk or counter.

The fact is this is a difficult decision because the government is aware that this is everyones retirement savingsThe i-Citra solution is taking the mid-road between the rakyats urgent needs and reasonable returns for EPF members who do not require withdrawals. 23 June 2020 Funds Received and KWSP. When you reach a certain age owning your own home will be high on your list of things to do.

Any withdrawal amount is always subject to whatever money is available in the applicants and where applicable joint applicants Account 2. Earlier EPF had also announced how members who withdraw from their Account 1 will have 100 of their future contributions directed into Account 1 until the amount they withdrew has been fully topped-up again. All members who lost their jobs or affected by pay cuts whether they are self employed active or non-active members are allowed to apply.

When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2. Receipt 2 EPF Withdraw. All in all settled within 45 minutes.

The withdrawal follows the standard EPF withdrawal as mentioned on the EPF website. Once this is done you will be given a temporary username and password. Follow through the steps for i-Akaun activation and your account will be ready for withdrawal.

For further enquiries regarding the Death Withdrawal please contact our Call Centre at 03-8922 6000 or log on to wwwkwspgovmy. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Just completed my withdrawal with KWSP JB.

If you still have doubts please do contact EPF ya. EPF Withdrawals for Housing.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

I Lestari Here S An Easier Way To Withdraw Rm500 From Epf Without Forms

39 Kwsp Account 2 Withdrawal For House Renovation Pictures Kwspblogs

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

Govt Okays Epf Account 1 Withdrawals Up To Rm6 000 Malaysianow

I Lestari How To Withdraw Rm500 Month From Your Epf Account

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

I Lestari Here S An Easier Way To Withdraw Rm500 From Epf Without Forms

Posting Komentar untuk "Can I Withdraw My Kwsp"