E-filing Lhdn 2019 Deadline

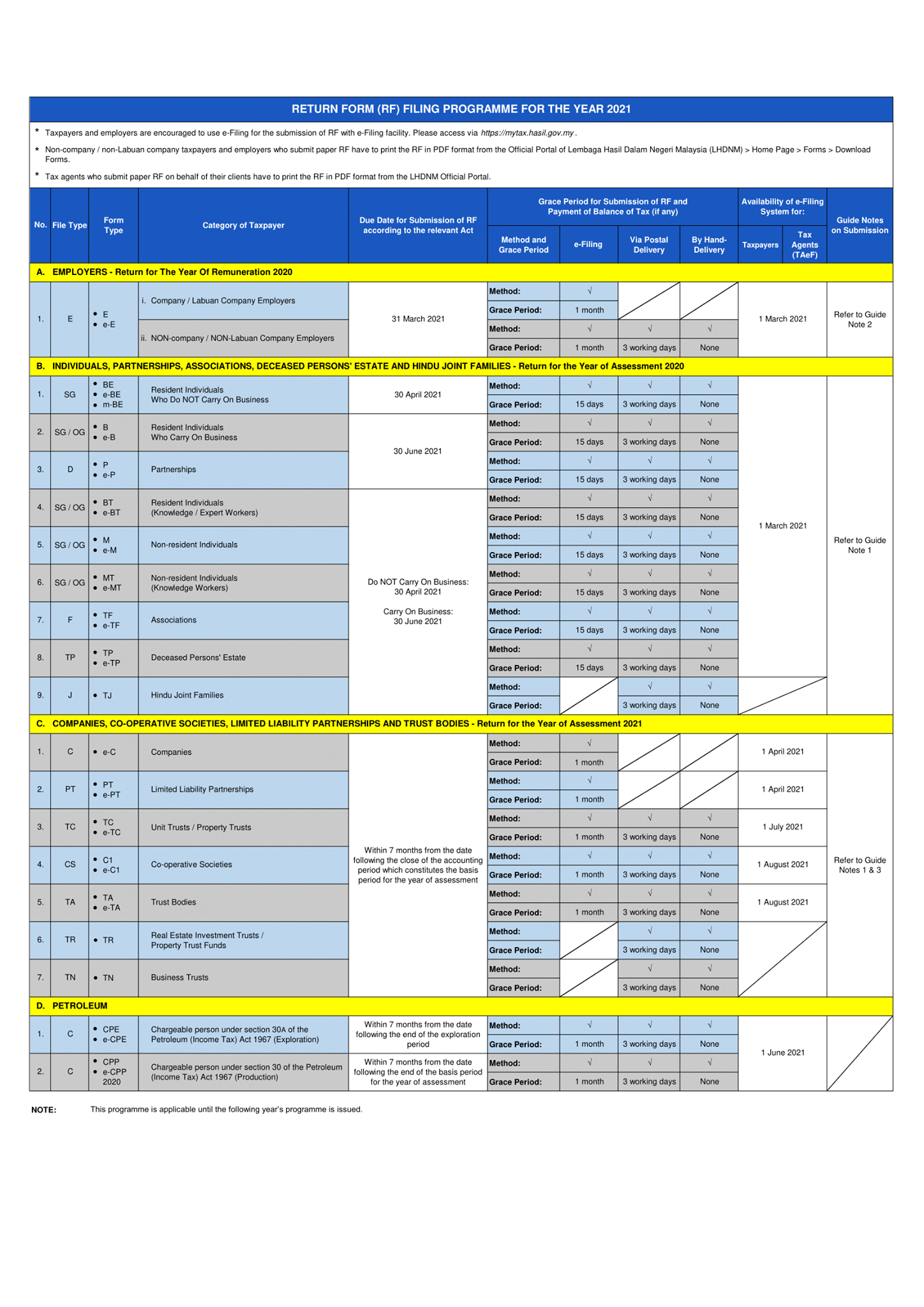

The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021. Tambahan masa diberikan sehingga 30 Jun 2020 bagi pengemukaan secara e-Filing pos atau serahan tangan.

BE e-BE April 30 2021.

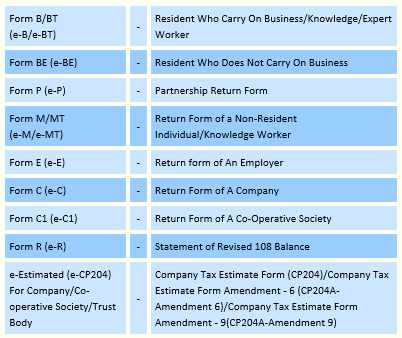

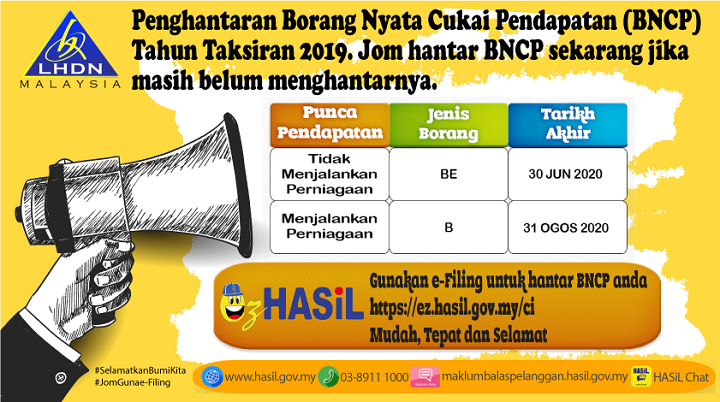

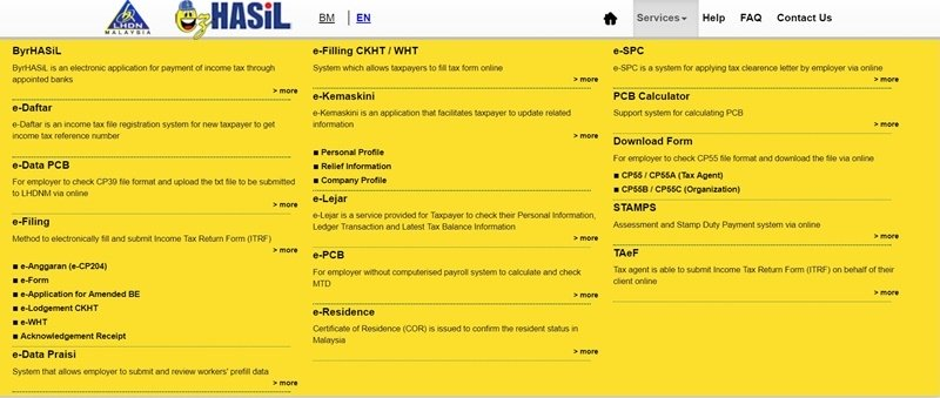

E-filing lhdn 2019 deadline. ByrHASiL adalah aplikasi elektronik untuk pembayaran cukai pendapatan melalui bank-bank yang dilantik. Bagi Borang BE pembayar cukai juga boleh mengemukakan borang. A spokesperson from LHDN said the deadline for submitting Form E is on March 31 while Form BE and Forms B and P are to be submitted by April 30 and June 30 respectively.

The deadline for Form B and P is June 30. Untuk makluman STOKC adalah pengesahan yang dikeluarkan oleh LHDNM ke atas status seseorang yang dikenakan cukai di Malaysia. The deadline for submitting Form E is March 31.

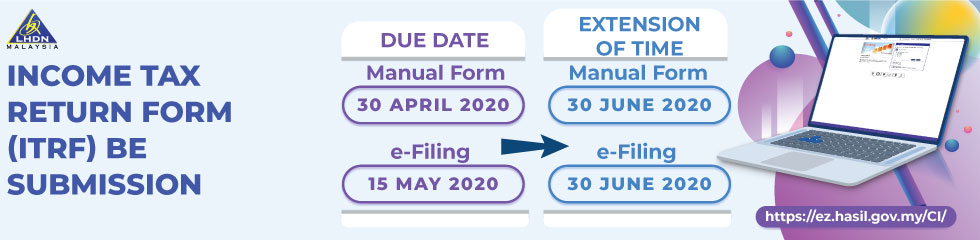

The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. Kaunter e-Filing LHDNM Dibuka Pada Hujung Minggu Ini. Income tax filing schedule for 2019 If you are a salaried employee without business income the two dates you need to know are 30 April for manual filing and 15 May for e-filing.

If a taxpayer furnished his Form e-BE for Year of Assessment 2019 on 16 May 2020 the. Cyberjaya 27 April Memandangkan tarikh menghantar Borang Nyata Cukai Pendapatan semakin hampir iaitu 30 April 2012 dimaklumkan kaunter perkhidmatan e-Filing akan dilanjutkan pembukaannya. If I missed the deadline can I combine 2 years incomes and declare tax at the second year at once.

4 Your income tax refund will be done through Electronic Fund Transfer EFT to your bank account. Lembaga Hasil Dalam Negeri MalaysiaInland Revenue Board Of Malaysia. Cannot tax submission is on yearly basis you might be imposed penalty if there is late submissionpayment.

Workers or employers can report their income in 2020 from March 1 2021. Utama Kenyataan Media. Bagi Tahun 2019 Pindaan 42019 Program Memfail Borang Nyata BN Bagi Tahun 2020 Pindaan 32020 Contoh Format Baucar Dividen.

Kegunaan majikan menyemak format dan memuat naik fail txt CP39 untuk dihantar. By kylekyle January 6 2021. Lembaga Hasil Dalam Negeri.

Resident Individual Knowledge Worker Expert Worker BT e-BT April 30 2021 For those who do not carry on any business June 30 2019 For those who carry. If you do have business income then you have more leeway 30 June for manual filing and 15 July for e-filing. Resident who carries on business.

E-Daftar adalah aplikasi permohonan pendaftaran fail cukai pendapatan untuk pembayar cukai baharu mendapatkan nombor cukai pendapatan. The deadline for BE is April 30. Grace period is given until 15 May 2020 for the e-Filing of Form BE Form e-BE for Year of Assessment 2019.

Mytaxhasilgovmy Sistem e-Filing akan dibuka mulai 1 Mac 2021 dan tarikh akhir penghantaran adalah pada 30 April 2021. 15072021 for e-filing. P e-P June 30 2021.

Form used by company to declare employees status and their salary details to LHDN. 31 July 2019 until 31 August 2019 ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019 Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 January 2020 until 31 March 2020 Form C Companies. Tarikh Akhir e-Filling 2021 LHDNPerhatian buat pembayar cukaiBila tarikh akhir hantar borang cukai efilling 2021 untuk tahun taksiran 2020.

Lembaga Hasil Dalam Negeri LHDN melalui lampiran yang boleh dirujuk di LHDN yang memaklumkan bahawa pembayar cukai boleh mengemukakan Borang Nyata Cukai Pendapatan BNCP tahun taksiran 2020 mereka melalui e-Filing bagi borang E BE B BT PM MT dan TF mulai 1 Mac 2021 ini. E e-E March 31 2021. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2019 adalah 30 April 2020.

The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline. Normally the deadline for resident individuals to file their taxes is 30 April for offline channels and 15 May for filing through e-Filing. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2019 pada 1 Julai 2020.

B e-B June 30 2021. Form C 31082019 31032020 31052020 LLP. Resident who does not carry on business.

Thus taxpayers are strongly encouraged to make full use of LHDNs online service ezHasiL when it comes to. Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker 30 April 2020 does not carry on any business 30 June 2020 carries on business.

Form PT 30092019 30042020 30062020 2 months grace period 31102019 31052020 31072020 30112019 30062020 31082020 31122019 31072020 31082020. Untuk makluman pengemukaan Borang Nyata Cukai Pendapatan BNCP Lembaga Hasil Dalam Negeri Malaysia untuk tahun taksiran 2020 melalui e-filling bagi borang E BE B BT P MT dan TF boleh dilakukan pada tarikh yang dinyatakan dibawah. Lanjutan daripada itu pengeluaran STOKC juga akan diberhentikan.

LHDN Year End Statutory Deadline E-Filing Extension ANNUAL TAX FILLING YA 2019 31072019 29022020 30042020 Company.

Psa Lhdn Extends Income Tax Filing Deadline To 30th June Soyacincau Com

You Now Have An Extra 2 Months To Submit Your 2019 Income Tax

Lhdn Income Tax Filing Deadline Is Next Week Trp

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tarikh Akhir Hantar Borang Cukai Efilling 2021 Tahun Taksiran 2020

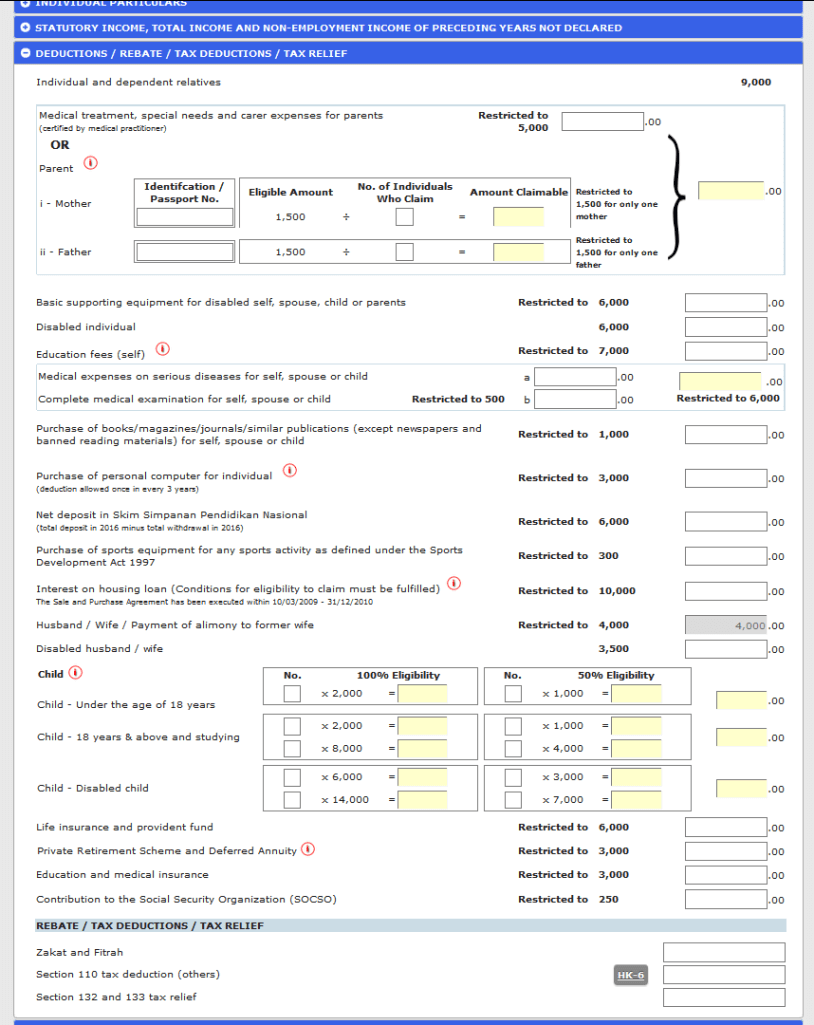

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Posting Komentar untuk "E-filing Lhdn 2019 Deadline"