Can You Take A Tax Deduction For Working From Home

The short answer is probably not. If you work from home there are a surprising number of things that may be tax-deductible for you including your home office work supplies and even your WiFi bill.

Work From Home Tax Deduction Only Applies To Self Employed Workers

Employees are not eligible to claim the home office deduction.

Can you take a tax deduction for working from home. Additionally your home office must be your primary place of business. Changes to Work-From-Home Tax Deductions. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return.

SAN MATEO Calif. You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. The new tax law eliminates miscellaneous itemized tax deductions for employees.

Gail Rosen before the 2018 tax reform bill you could deduct employee business expensessuch as the home office expenses for employees who telecommuteas a miscellaneous itemized deduction on Schedule A. If youre still going into an office three days a week and working from home twice a. You may be able to claim tax relief on the additional costs of working from home including electricity heat and broadband.

KGO -- If youre fortunate enough to be working at home during the coronavirus pandemic you may be wondering if you can take a tax deduction. Unfortunately most employees working from home cant claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic. So if you are an employee then you can only qualify if you perform your employment duties for more than half the time at your home office explains Du Toit.

Given that the lockdown will not extend beyond six months or so we think it cannot be said that an ordinary employee performed their duties mainly at their homes during the year of tax assessment. If youre a self-employed business owner you can claim a tax deduction if you work from a home office or other home workplace. Working from home also known as remote working or e-working is where you work from home for substantial periods on a full- or part-time basis.

This includes if you have to work from home. Under the rules it does not have to be a full-time business. If you work in real estate you can deduct the fees you pay to the National Association of Realtors.

When the tax reform bill became law at the end of 2017 employees lost the ability to deduct expenses related to maintaining a home office for tax years 2018-2025. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. However your home office deduction can be.

How you can claim tax deductions for a home office The Income Tax Act sets out basic requirements that must be met if this tax relief is to apply. If youre a CPA you can deduct your annual membership to the American Institute of Certified Public Accountants AICPA. It can be a side gig.

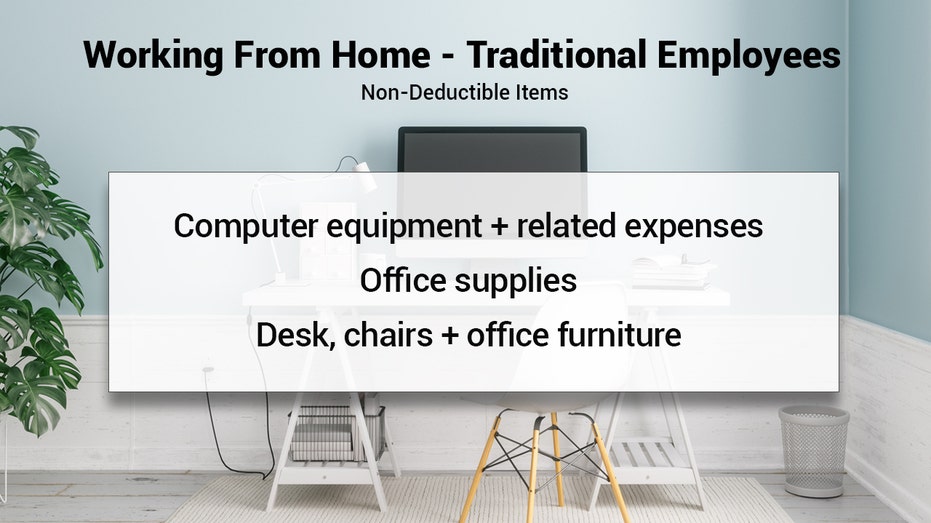

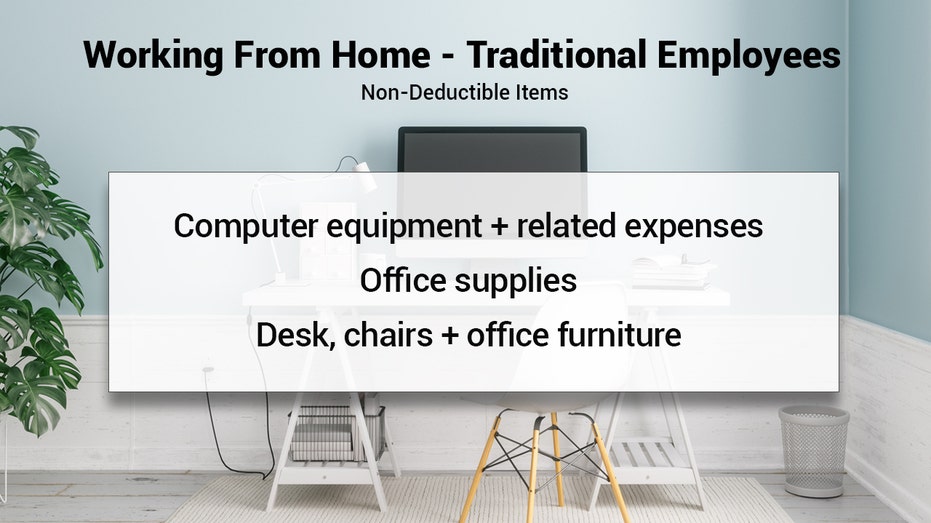

Here are some things to help taxpayers understand the home office deduction and whether they can claim it. For much of 2020 however many employees have maintained home offices and are spending a great deal more money on work from home expenses. Through 2025 you can no longer take a deduction for new computer equipment or furniture for your home office not to mention other job-oriented outlays like fees to professional associations and union dues.

You must practice a trade which can be employment so by being employed this criterion is fulfilled. But that ended with the Tax Cuts and Jobs Act of 2017 or TCJA which ended miscellaneous itemized expenses. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

Tax Deductions When Working From Home Everything To Know Fox Business

A Guide To The Home Office Tax Deduction Personal Finance Us News

Working From Home Because Of Coronavirus You Can Reduce Your Tax Bill

Work From Home Here Are The Tax Deductions That You Re Missing Mcleod Associates

I Ve Been Working At Home During The Pandemic Do I Qualify For Home Office Tax Deductions Marketwatch

Working From Home Can You Claim The Home Office Deduction On Your 2020 Tax Return Kiplinger

The Home Office Tax Deduction The Reason You Can T Use It Even After Working From Home For A Year Cnet

Working From Home Tax Deductions Covid 19

Home Office Deduction One Of The Most Misunderstood Tax Breaks

Tax Deductions You Must Have If You Work From Home

Posting Komentar untuk "Can You Take A Tax Deduction For Working From Home"