E Filing Borang E Due Date

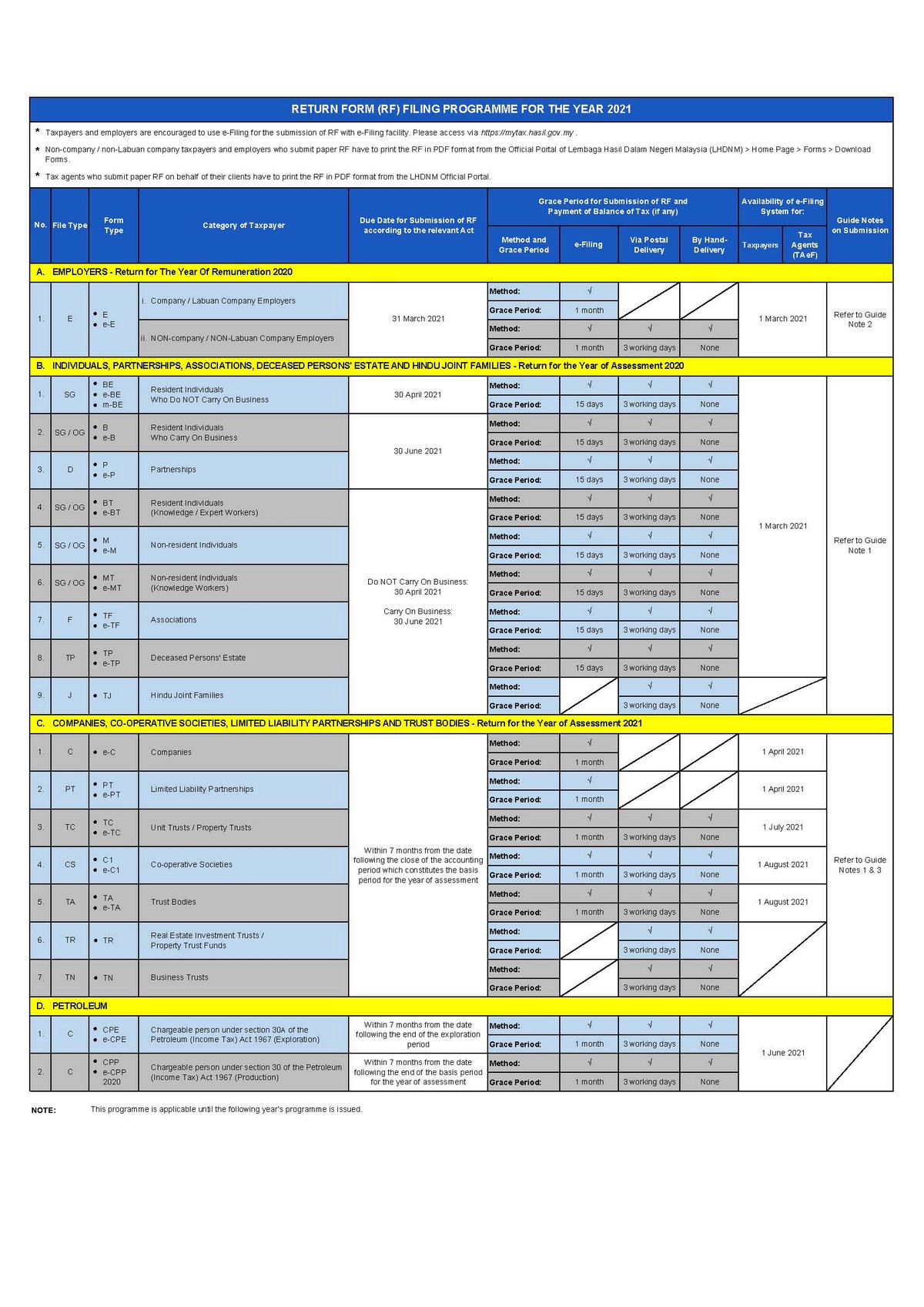

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2020 adalah 30 April 2021. Filing of Return Form of Employer Form E must submit together with CP8D Form.

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Cyberjaya 27 April Memandangkan tarikh menghantar Borang Nyata Cukai Pendapatan semakin hampir iaitu 30 April 2012 dimaklumkan kaunter perkhidmatan e-Filing akan dilanjutkan pembukaannya.

E filing borang e due date. A e-Filing NB. Lhdn E Filing 2020 Due Date The due date for submission of the reits rf form tr for year of assessment 2020 is 31 december 2020. E-Filing is not available for Form TJ.

Filing your tax through e filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on april 30. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2020 pada 16 Mei 2021 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2021 dan. 0800 hrs - 2000 hrs.

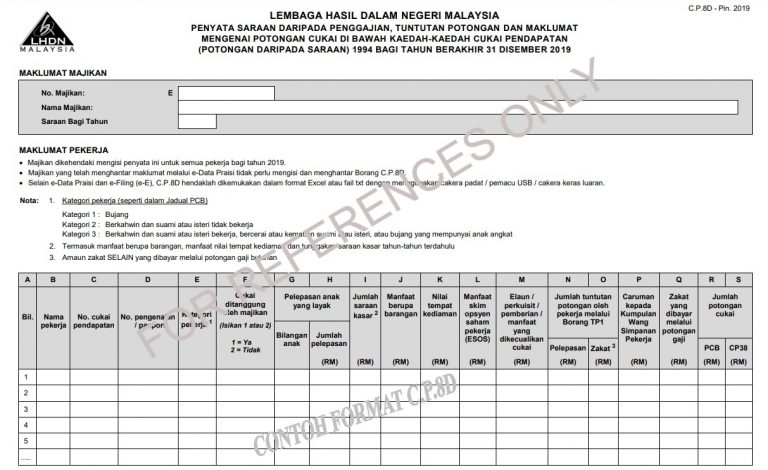

2019 Malaysia Personal Income Tax E Filing A Quick Guide. Lembaga Hasil Dalam Negeri. E-Data Praisi on or before 25 February 2021.

E-Filing Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Form to be received by IRB within 3 working days after the due date. Ia adalah untuk memudahkan pembayar cukai menggunakan e-Filing di mana praisi prefill telah dibuat pada borang e-Filing.

Monday to Saturday e-filing and Centralized Processing Center. Kaunter e-Filing LHDNM Dibuka Pada Hujung Minggu Ini. FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker 30 April 2020 does not carry on any business.

Muat Turun Layout Maklumat Praisi. The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021. B Via postal delivery.

1800 103 0025 or 1800 419 0025. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. 31 March 2019 Form E will only be considered complete if CP8D is submitted on or before 31 March 2019.

Due date to furnish this form. Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of Assessment 2020. I For submission by post please return to.

Tarikh akhir penghantaran borang cukai e filing 2020 taksiran tahun 2019. Joint assessment Due date for submission both Form BE and B is 30th June. Two 2 months grace period from the due date of submission is allowed for those with accounting period ending January 2020 until 31 March 2020.

Utama Kenyataan Media. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Within one month after the due date 30 April 2021 Important Notes.

Due date for submission of Form B is 30th June. General Form E submission deadline. Separate assessment - Due date for submission of Form BE is 30th April.

Tambahan masa diberikan sehingga 15 Mei 2021 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2020. Within 15 days after the due date. Forms B BT M MT P TF TJ and TP for YA 2020 for taxpayers carrying on a business.

Borang E dan CP8D on or before 31 March 2021 Extension of Submission Due Date Only applicable for online e-filing e-Filing Borang BE 15 days 15 May 2021 e-Filing Borang B 15 days 15 July 2021 e-Filing Borang E 1 month 30 April 2021 Method for submission of Borang E CP8D. Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending September 2019 until 31 December 2019. Employers who have submitted information via e-Data Praisi need not complete and furnish CP8D.

Apabila pembayar cukai menggunakan e-Filing maklumat tersebut boleh dipinda jika terdapat sebarang perubahan sebelum tandatangan dan hantar borang secara elektronik. Lembaga Hasil Dalam Negeri Malaysia Pusat Pemprosesan. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021.

30th august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. Where do I need to submit the Form B. Resident Individuals who do not carry on businesses can submit their e-BE Year of Assessment 2020 via MyTax.

E-Filing Submission Period of Extension INCOME TAX RETURN FORM SUBMISSION BE FORM DUE DATE EXTENSION TIME Manual Form 15 MAY 2020 30 APRIL 2020 30 JUNE 2020 30 JUNE 2020. If a taxpayer furnished his Form e-BE for Year of Assessment 2020 on 16 May 2021.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

How To Prepare File And Submit Lhdn E Filing 2021 Conveniently

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Borang E Fill Out And Sign Printable Pdf Template Signnow

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Business Income Tax Malaysia Deadlines For 2021

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

Posting Komentar untuk "E Filing Borang E Due Date"