Do Islamic Banks Take Interest

Islamic banks are partners not lenders. It is down to you as a Muslim to lay down a marker and save yourself from the evil indulgence of riba dealings.

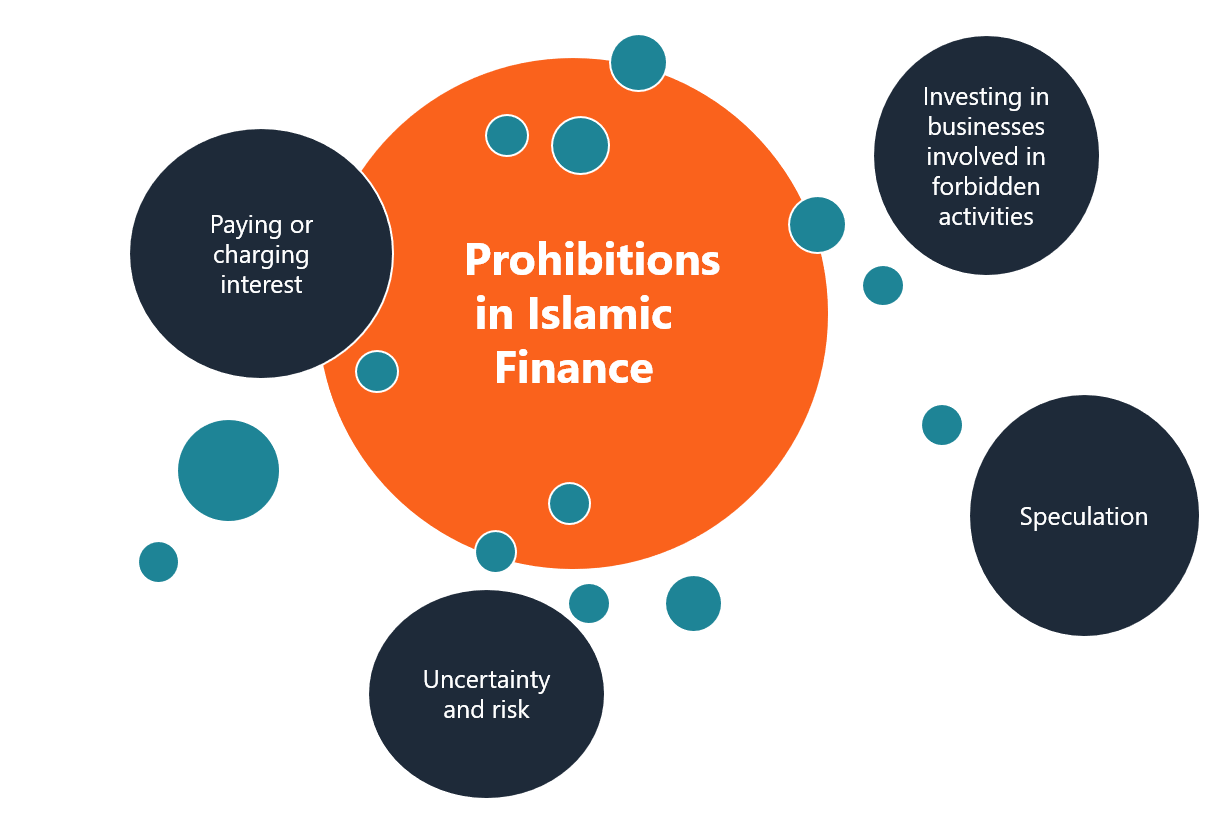

Islamic Finance Principles And Types Of Islamic Finance

Instead the concept of profit and loss sharing comes into play.

Do islamic banks take interest. While not every Muslim believes that charging interest is wrong it is part of Islamic or Sharia law and Islamic finance where no interest is charged is practised in a growing number of banks around the world. They dont deal in Interest at all based on their framework. But how does the credit union make money on.

Any transaction or loan where the payment of an additional amount on the principal is made conditional to the advance of such a loan is called riba. Bank interest and Muslim society By Abdur Rahman Hamza. One of the golden features of the Islamic banking business is the prohibition of interest in financial transactions.

But one can deposit money in it with the niyyat of not earning interest and can use full profit from it. An increase in interest in ethical banking after the 2007-8 financial crisis has boosted awareness of Islamic banking. Islamic banks are strictly forbidden to charge interest.

But Islamic Banks may make money via Illegal andor Haraam businesses. Making up about twenty-three percent of the worlds population 16 billion Muslims still look to financial institutions to help them buy homes and earn a return on their money. Under Sharia law certain techniques used by conventional banks are forbidden such as charging and paying interest.

There has been confusion about riba interest among Muslims all over the world especially among the Indian Muslims. Interest is strictly forbidden in Islam and to. The most common form of riba these days is interest whether that paid on bank accounts or loans.

It is permissible to deposit money in a bank without prior condition for interest and it is as well permissible to take interest if the bank in which money is deposited belongs to Muslims. Profits are made through legitimate source which are incompliance with the SHARIAH Law. Depositors also share in the banks profits which.

In Islamic banking however interest means over and above the principal loaned out for a period. To answer such tricky question we should go to basic characteristics of Islamic banks. If the bank is run by both muslim and kafir individuals in this bank both the above parties are involved so both have partnership on each rupee of bank so can not take cash loan from it.

You dont need to be Muslim to take out an Islamic bank account and if youre interested in Islamic financial principles it could be something to look into. Sharia-compliant banks have been experiencing a period of rapid growth especially in the non-Muslim-majority world. The only logical thing I can deduce would be that the banks make money through late fees and interest in lending mortgages and loans and that money then comes back to the earned money by banks which pay your interest earned from your saving as it increases for the banks.

Having said that Yes Islamic Banks make money via Mudharabah Wadiah Musharakah Murabahah and Ijarah and other services. North Jersey FCU launched its Islamic banking products in 2010 making it the first credit union in the US. Like Musharaka Mudariba Islamic Bonds and etc Like any buisiness not involving drugs alcohole interest and other tabbooed items.

Short Answer is Islamic banks cannot charge Interest and they arrange the transactions in a way that Banks will buy back or sell the loan or deposit respectively and difference in the pricing is the margin or profit they work on depending on the period of such transactions. Staying away from interest accruing accounts if you are with a commercial bank. How do Islamic banks.

Banks are by far the biggest players in Islamic finance some of them are exclusively Islamic while others offer sharia-compliant products but remain mostly conventional. Islamic banks dont charge interest but instead participate in the yield that results in the use of funds. Many of the products offered by Islamic financial institutions are comparable to Western or conventional finance even though interest and speculation are forbidden.

In spite of efforts of the ulama to find a solution the confusion remains. Here are few ways to start. Borrowing from friends and family that wont charge you interest.

I dont have any proofs Why would i even think of it. Literally interest means over and above a thing be it in money terms or in physical units of goods. The money that you are going to take after five years will be composed of the capital which is the money paid by the company and the riba-based profits which are known as interest.

Is it permissible to deposit or borrow money from Muslim banks whereby the interest is either received or paid out. Because riba-based money is not permissible for you you have no right to take any more than the capital and you have to leave the interest to the bank because Allaah says interpretation of the meaning. 3 Kafir bank.

We have members of the Muslim community using our Islamic checking and Islamic savings products Giffin said. Dealing with Islamic bank as opposed to commercial banks.

Islamic Finance The Lowdown On Sharia Compliant Money Islamic Finance The Guardian

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

Islamic Banking Interest Free Or Interest Based Sciencedirect

Islamic Banking And The Alternative To Interest Paying Mapping Ignorance

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Islamic Finance We Could Learn A Lot Of Economic Lessons From How Muslims Use Money Quartz

What Is Islamic Finance And How Does It Work Global Finance Magazine

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Posting Komentar untuk "Do Islamic Banks Take Interest"