Can I Write Off Home Repairs On My Taxes

Home repairs do not fall under any IRS category that will let you deduct them out of that years taxes no matter how much they affect the house or why they were accomplished. Repairs and improvements to your primary residence or 2nd home are not deductible.

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

If You Qualify for the Home Office Deduction.

Can i write off home repairs on my taxes. Can you write off home repairs on your taxes for going green. Some Home Repairs May Be Eligible to Be Claimed as Medical Expenses. As far as taxes are concerned repairs to a personal residence are meaningless.

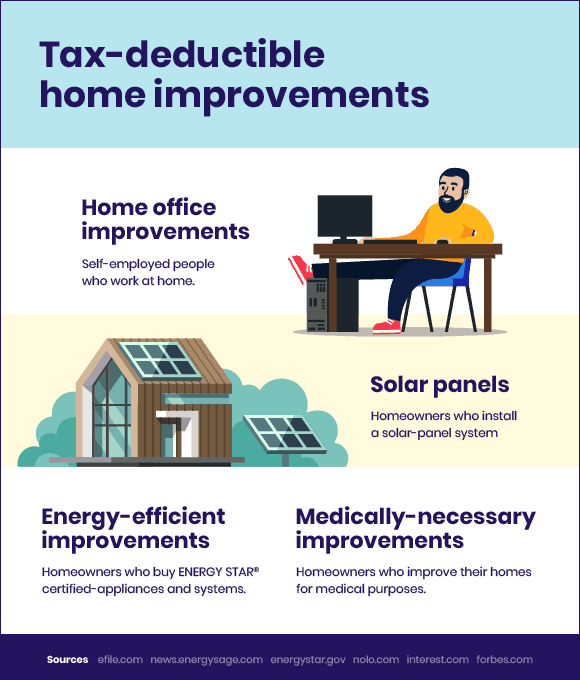

These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Are you looking to renovate your home. However there are certain tax advantages that you can gain from the work in some scenarios.

Through 2016 qualified alternative energy generation systems like solar water heaters small wind turbines and solar panels are eligible for a one-time tax credit of 30 percent of the cost. However property improvements add to the cost basis of your house. Youll then be able to subtract the interest on your home repairs from your income via the mortgage interest deduction.

Those costs wont matter until the year one of three things happens in your life. As an exclusive rental property you can deduct numerous expenses including property taxes insurance mortgage interest utilities housekeeping and repairs. But certain home-improvements are tax deductible and can be utilized to reduce the amount of tax you pay to Uncle Sam.

But you dont report those anywhere. Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your taxes. These costs are deductible whether you hire someone or do them yourself.

Much like a home office space you can write off the cost of repairs to your rental property and then depreciate improvements. While you cant write off home improvements as an item on your income tax return certain home renovations will qualify as capital improvements. If 200 square feet of your 2000-square-foot home is a home office you can write off 60 or 10 percent of the cost of the repair with your home-office deduction.

There are both tax credits and deductions that can be taken when the purchase was made or afterwards. Lets look at them. Thats pretty basic and cool enough.

If you are making medically required repairs you can deduct them from your income. The only way you can deduct all or part of the cost of home repairs for your residence is if you qualify for the home office deduction or rent out part of the home. If your home sale profits exceed the capital gains exemption threshold 250000 for single filers and 500000 for married filers you can add capital improvements to your cost basis.

Usually you cant expect to deduct anything from your Federal tax return just because you decided to make changes to your home. Even towels and sheets can. Repairs can be deducted immediately if the total amount paid for repairs and maintenance on the property is 10000 or under or 2 of the unadjusted basis of.

That tax break no longer exists. But you can mitigate your tax liability by reducing the amount of home sale profit the IRS considers taxable. If your upgrade is a legitimate.

Capital improvements can save you from paying more in capital gains when the time comes to sell your home. The interest you pay for your mortgage can be deducted and is limited to interest on 750000 of mortgage debt for debt incurred after Dec. But consider that if you rent out a portion of your own home it works like the home office deduction.

You can deduct the home office percentage of home maintenance expenses that benefit your entire home such as housecleaning of your entire house roof and furnace repairs and exterior painting.

9 Amazing 1099 Independent Contractor Tax Deductions Next Insurance

Tax Breaks For Capital Improvements On Your Home Houselogic

5 Tax Deductions When Selling A Home Did You Take Them All

Are Home Improvements Tax Deductible It Depends On Their Purpose

Tax Deductions And Home Improvement Projects Taxact Blog

Here Are 5 Expenses You Can Write Off When Selling A House

Tax Deductions And Home Improvement Projects Taxact Blog

Tax Deductible Home Improvements For 2021 Budget Dumpster

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

Tax Differences Between Home Repairs Home Improvements Don T Mess With Taxes

Posting Komentar untuk "Can I Write Off Home Repairs On My Taxes"