E Hasil Submission Due Date

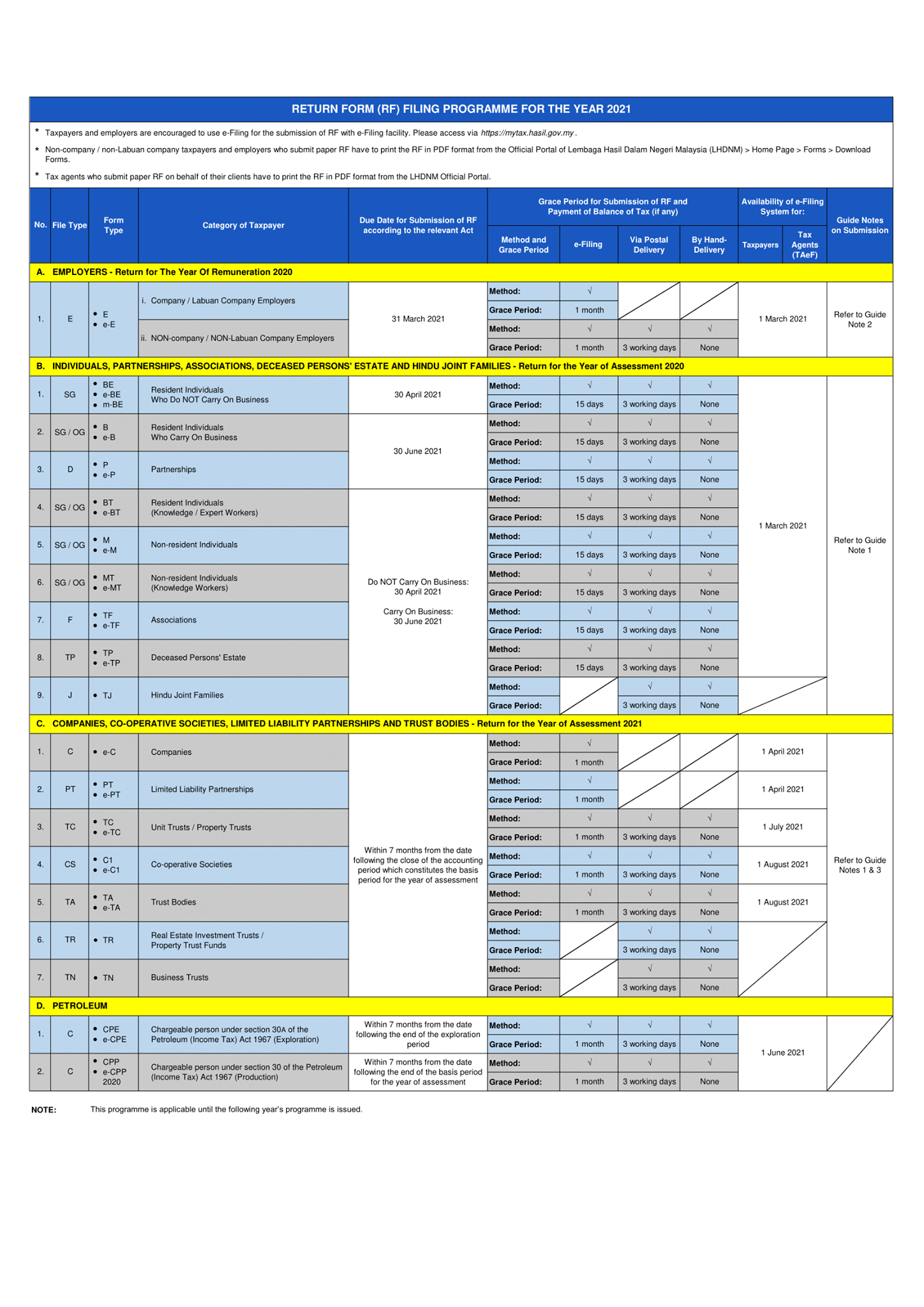

SCHEDULE ON SUBMISSION OF RETURN FORMS FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2020 Employer 31 March 2021 BE 2020 Resident Individual Who Does Not Carry On Any Business 30 April 2021 B 2020 Resident Individual Who Carries On Business 30 June 2021 P 2020 Partnership BT 2020 Resident Individual Knowledge Worker Expert Worker. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021.

E hasil submission due date. B Via postal delivery. Submission Due Date Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021 Individual BE form without business source - on or before 30 April 2021 Individual B form with business source - on or before 30 June 2021. Grace period is given until 6 January 2020.

Grace period is given until 15 May 2020 for the e-Filing of Form BE Form e-BE for Year of Assessment 2019. If a taxpayer furnished his Form e-BE for Year of Assessment 2020 on 16 May 2021. Please attached you identification document during submission.

4 Your income tax refund will be done through Electronic Fund Transfer EFT to your bank account. Choose Borang to file tax according to the source of income. If Lembaga Hasil Dalam Negeri Malaysia LHDNM received the RF via postal delivery on 7 January 2020 the receipt of the RF shall be considered late as from 1 January.

NON-Companies can submit FORM E Manually Employers other than companies have the option to submit Form E via e-Filing or manually Paper FormThe due date for manual submission of Form E for the year of Remuneration 2016 is on 31 March 2017. Form E Non-company Non-Labuan company employers 31 March 2021. After obtaining No Pin e-Filing and No Rujukan click on the following URL to log in to the income tax page-Select Login kali pertama.

E-BE part-time worker. Within 3 working days after the due date. For individual e-filing PIN application via e-mail can be made using Customer Feedback Form.

Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending September 2019 until 31 December 2019. SCHEDULE ON SUBMISSION OF RETURN FORMS FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker. Two 2 months grace period from the due date of submission is allowed for those with accounting period ending January 2020 until 31 March 2020.

Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of Assessment 2020. Please press to obtain the e-form year of assessment 2013. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5.

Normally the deadline for resident individuals to file their taxes is 30 April for offline channels and 15 May for filing through e-Filing. E-Filing Submission Period of Extension INCOME TAX RETURN FORM SUBMISSION BE FORM DUE DATE EXTENSION TIME Manual Form 15 MAY 2020 30 APRIL 2020 30 JUNE 2020 30 JUNE 2020. Please click here to enter Customer Feedback Form.

Form to be received by IRB within 1 month after the due date. The due date for submission of the REITs RF Form TR for Year of Assessment 2019 is 31 December 2019.

The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021. No grace period. 31032021 30042021 for e-filing 𝟒.

The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021. The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. Fill in the information according to the matter and.

If a taxpayer furnished his Form e-BE for Year of Assessment 2020 on 16 May 2021. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of Assessment 2020.

For OeF PIN Number application company must use CP55B form. Thus taxpayers are strongly encouraged to make full use of LHDNs online service ezHasiL when it comes to. Within 1 month after the due date.

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

How To Prepare File And Submit Lhdn E Filing 2021 Conveniently

Http Www Hasil Gov My Pdf Pdfam Programmemfailbn 2020 Pin 3 2 Pdf

Ks Chia Associates Filing Programme For Income Tax Return Forms Year 2020 Http Lampiran1 Hasil Gov My Pdf Pdfam Programmemfailbn 2020 02012020 2 Pdf Facebook

Income Tax Deadline Extended Until 30 June 2020

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

Psa Lhdn Extends Income Tax Filing Deadline To 30th June Soyacincau Com

Posting Komentar untuk "E Hasil Submission Due Date"