Can I Write Off Home Expenses On My Taxes

Office supplies like pens pencils papers and staplers. Considering that you probably spent most of 2020 primarily working from home this is a deduction that should be a priority.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

If youve been paying into an escrow account you can only deduct the amount that your lender paid this should be reflected on your property tax bill.

Can i write off home expenses on my taxes. If your lease is 400 a month and you use it 50 percent for business you may deduct 2400 200 x 12 months. Usually you cant expect to deduct anything from your Federal tax return just because you decided to make changes to your home. While you cant write off home improvements as an item on your income tax return certain home renovations will qualify as capital improvements.

That tax break no longer exists. You can deduct state and local income taxes. If you make improvements to your home for medical purposes -- such as adding wheelchair ramps or lowering cabinets for better accessibility -- you can deduct those renovations as medical expenses.

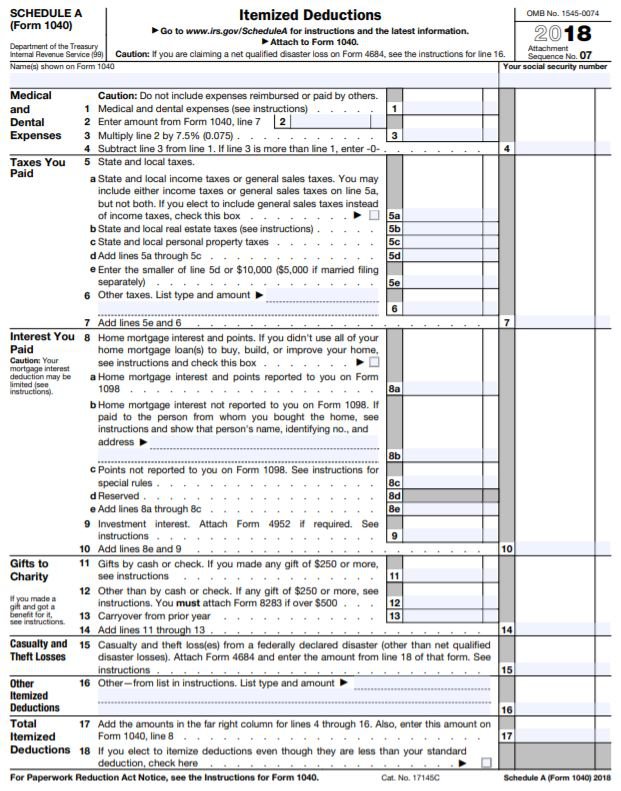

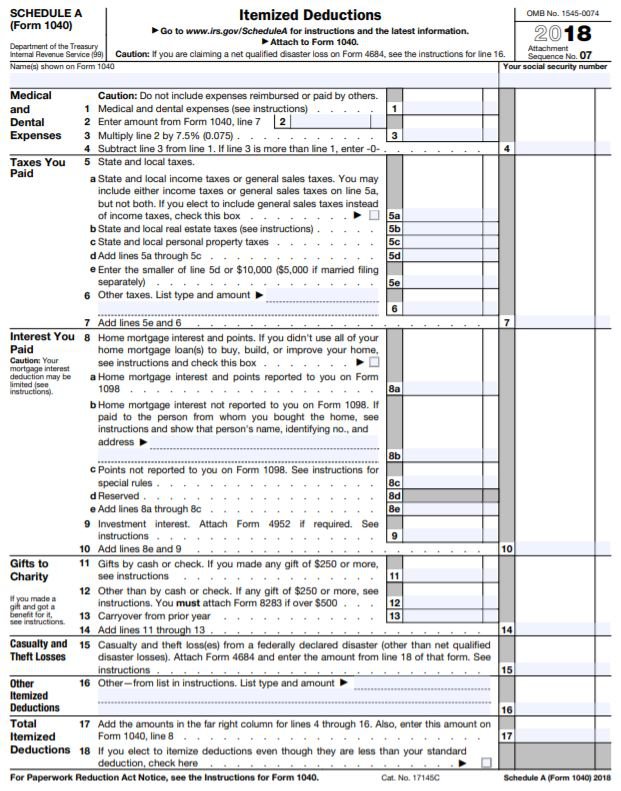

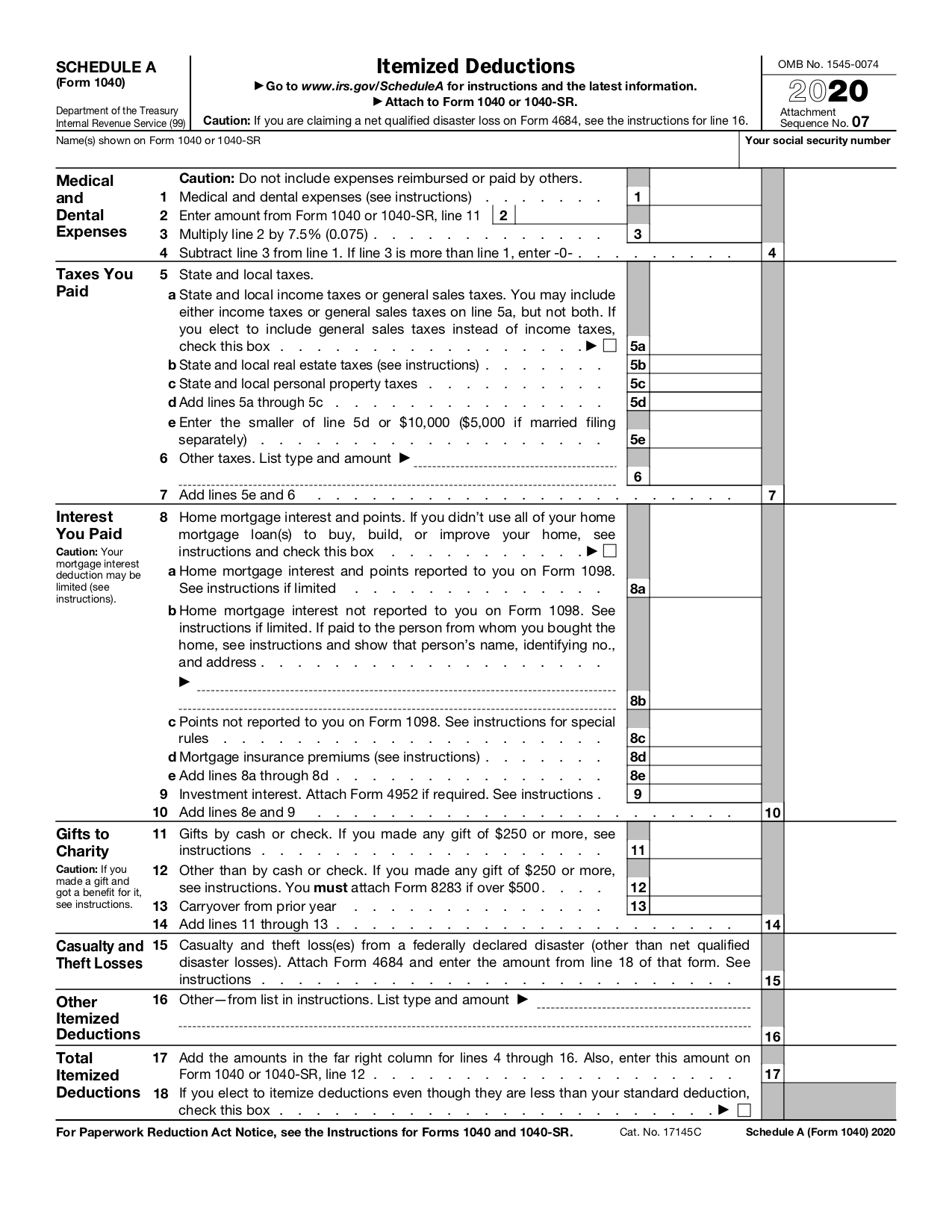

If you use part of your home regularly and exclusively to perform administrative or managerial activities for your business you can claim a home office deduction Lisa Greene-Lewis a tax. While its best to work with a tax professional who can crunch the numbers accurately and assess your situation better than we can it might also be a good idea to review Schedule A Form 1040 from the IRS to get acquainted with the details of how itemizing real estate taxes work. While most do not qualify for this deduction because the RV is your main home there are a few exceptions to this.

If youre writing career qualifies as a business you can deduct all necessary and ordinary costs that you incur as part of your operations. Even then the deductible amount of these types of expenses may be limited. If you maintain a primary home and use the RV to visit clients or to secure supplies for a business then it may be deductible.

Many people ask me about deducting RV expenses on taxes and I caution them from taking this deduction. Maybe you bought some supplies a new desk or a chair or youre just paying more for a better Internet connection. To make sure you can write off your property taxes you need to itemize your deductions.

Once upon a time work from home expenses that werent reimbursed by your employer could at least be written off on your tax return. Some of the personal expenses such as mortgage interest and real estate taxes will still be deductible on Schedule A. If you use your home as a primary location for your trade or business your primary location for meeting patients or clients as the storage place for inventory or product samples rental use or a daycare facility you can write off part of your home expenses.

They include mortgage interest insurance utilities repairs maintenance depreciation and rent. Capital improvements can save you from paying more in capital gains when the time comes to sell your home. Website registration and hosting fees.

However you can only deduct the amount of your total medical expenses that exceed 75 of your adjusted gross income. If you split your property tax burden with the person who sold you a home you can only write off the portion you actually paid. Taxpayers must meet specific requirements to claim home expenses as a deduction.

As such you may be able to write off costs like rent mortgage interest utilities real estate taxes repairs or inventory. If so you may be wondering if youre allowed to take the home office tax. But that ended with the Tax Cuts and Jobs Act of 2017 or TCJA which ended miscellaneous itemized expenses.

For a writer common tax deductions include. Home office expenses. The amount you can write off depends on whether the expense is Direct which means that it only benefits your home office or Indirect offering a benefit to your entire home.

There are certain expenses taxpayers can deduct. You can deduct the business portion of your lease payments. But certain home-improvements are tax deductible and can be utilized to reduce the amount of tax you pay to Uncle Sam.

So you can only write off 75 of the expenses as rental expenses -- 75 rental days divided by 100 total days of use works out to 75. If you make home repairs or upgrades related directly to your business space you may also write these expenses off on your taxes. Under the Tax Cuts and Jobs Act TCJA all state and local income taxes SALT including property taxes are limited to 10000 in deductions.

Can I write off my lease payments on taxes. Through 2025 you can no longer take a deduction for new computer equipment or furniture for your home.

Are Property Taxes Deductible Guide Millionacres

Working From Home During Coronavirus Don T Expect To Write Off Home Office Expenses On Your Taxes Oregonlive Com

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Publication 587 2020 Business Use Of Your Home Internal Revenue Service

Tax Savings For The Self Employed

Itemized Deductions Definition Who Should Itemize Nerdwallet

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

Posting Komentar untuk "Can I Write Off Home Expenses On My Taxes"