Can I Claim Expenses For Working From Home During Covid 19

Expenses you can claim. Budget 2021 It was announced in Budget 2021 that the following expenses will be covered as an allowable home expense for e-working tax relief.

I Ve Been Working At Home During The Pandemic Do I Qualify For Home Office Tax Deductions Marketwatch

Coronavirus Covid-19 claiming home-working expenses.

Can i claim expenses for working from home during covid 19. Doesnt permit you to work from their premises due to COVID-19 and the other conditions set out above are met this could mean you can claim a deduction for appropriate working from home costs. Annual leave during COVID-19 You continue to build up your annual leave when you are working from home and working your usual hours. Due to the coronavirus COVID-19 pandemic millions of employees who ordinarily work at an office or other workplace provided by their employers are now working at home.

If these conditions are met you can deduct from your earnings. This is to cover all your extra costs of working from home. You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

This includes if you have to work from home. COVID-19 Employment allowances and reimbursements However in many cases you will be expected to bear these additional costs. People claiming their working from home expenses using the shortcut method should include the amount at the other work-related expenses question.

But here unlike this tax year you should only claim tax relief for the weeks you were working from home not the whole year. If your employer requires you to work from home ie. If you were required to work from home before lockdown the case for many at the start of the pandemic you can still put in a claim for relief for that period assuming of course you had increased expenses.

However employers may not want you to keep all your leave until later in the year. The extra unit costs of gas and. If youre working for an employer youre generally not able to deduct any costs incurred from income earned.

If you have been asked to work from home because of the COVID-19 emergency you may be able to claim tax relief against the cost of home expenses. Qualifying for a home office tax deduction during the coronavirus crisis. Rather than having to work out all the different minute expenses the tax office has created a temporary shortcut method to claim expenses for millions of people forced to work from home.

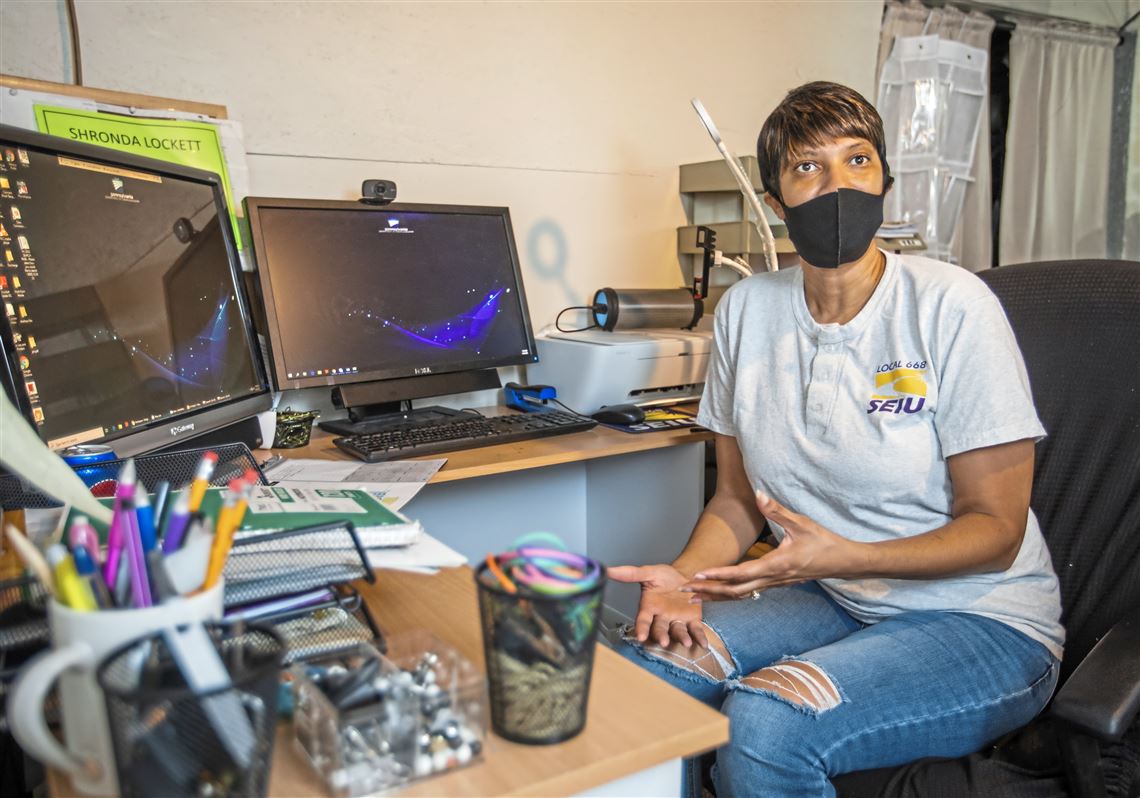

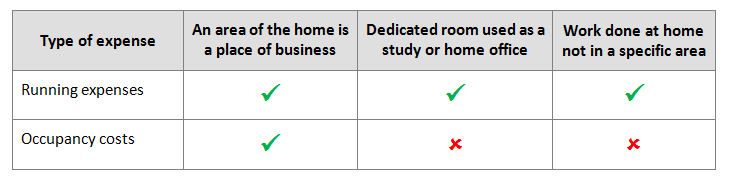

April 10 2020. If youve been locked-down working from home due to COVID-19 youll only be able to claim a home office deduction if you end up working from home for more than six months of the tax year provided you have an area of your home exclusively used and set up for this purpose. Now millions of Americans find themselves working from home and theyre the.

You can claim 080 for every hour you worked from home. Eligible employees are able to deduct up to 2 for each day they worked from home in 2020 due to COVID-19 up to a maximum of 400 without having to provide any special forms or documentation to. Unfortunately most employees working from home cant claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic says Sundin.

Expenses you pay because youre working from home cannot be claimed against your income. You may not want to take annual leave during the COVID-19 restrictions as your travel options are limited. Normally claims for tax relief for unreimbursed home-working expenses would only be eligible for tax relief from HMRC if a staff member worked from home on a regular basis under a formal arrangement agreed by the University ie.

If youve been forced to work at home due to the COVID-19 pandemic you might be able to claim some of your household expenses on your income tax. As America tries to contain the spread of COVID-19 businesses have made tough decisions to stay afloat and maintain a healthy work environment for employees. If you work from home you can claim a deduction for the additional expenses you incur.

While you can no longer get a tax deduction for work at home expenses here are some other ways you can get reimbursed for these costs including as qualified disaster relief payments. Those who work at home on a voluntary ad-hoc basis would be ineligible to claim. Working from home.

Electricity expenses associated with heating cooling and lighting the area from which you are working and running items you are using for work. What I can claim. 1 March 2020 to 30 June 2020 in the 201920 financial year 1 July 2020 to 30 June 2021 the 202021 financial year.

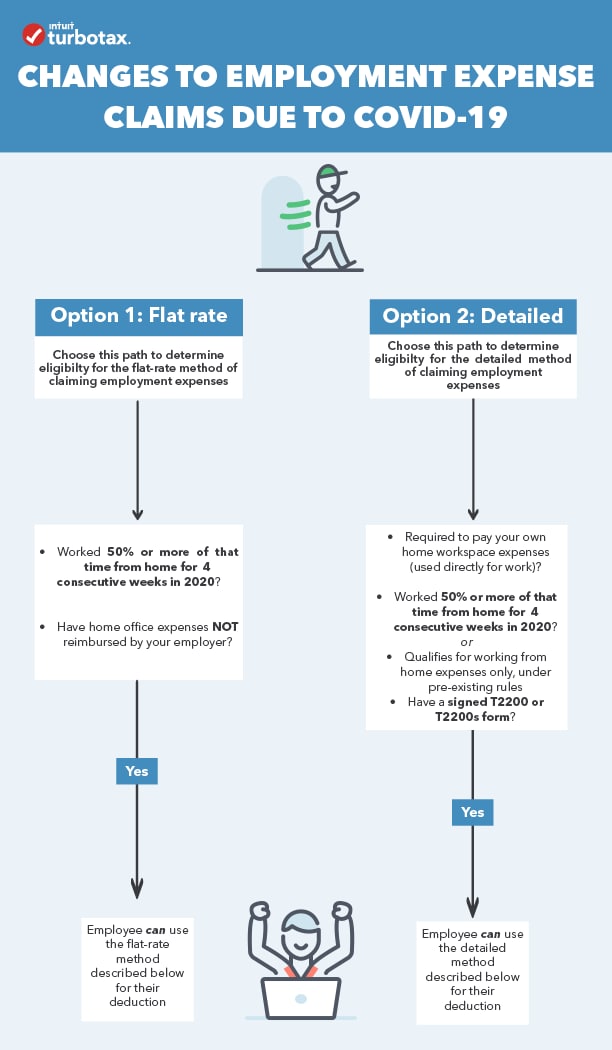

Am I Eligible To Claim Employment Expenses Due To

Can You Claim The Home Office Tax Deduction If You Ve Been Working Remotely Here S Who Qualifies Marketwatch

Should You Be Reimbursed For Home Office Expenses After Working From Home Due To Covid 19 Pittsburgh Post Gazette

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Claiming Work From Home Expenses During Covid 19 W Wen And Co

I Work Remotely During Covid 19 Can I Take A Home Office Tax Deduction Rkl Llp

Kalfa Law Covid 19 Cra Home Office Expenses

Women Less Likely To Feel Fairly Compensated For Work From Home Expenses During Pandemic Accounting Today

Https Assets Kpmg Content Dam Kpmg Ca Pdf 2021 01 Getting Reimbursed For Work At Home Expenses During Covid 19 Pdf

Posting Komentar untuk "Can I Claim Expenses For Working From Home During Covid 19"