Can I Write Off Home Care Expenses On My Taxes

If you order your products from a professional supplier and only use them for performances or shoot then you can claim the deduction. We hate to disappoint but the vast majority of home improvements wont qualify for deductions says Stephanie Ng CPA and author of How to Pass the CPA Exam.

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

This publication covers senior care tax-related issues families need to be aware of including the criteria that must be met to claim a tax deduction and what you can deduct for a spouses medical care.

Can i write off home care expenses on my taxes. Your work outfit has to be specific to the work you do as a Healthcare Professional Pharmacist or Nurse. In most cases caregivers and private nurses can be considered household employees. Because senior care tax deductions are so complicated it is generally best to seek the advice of an accountant or financial planner who has experience in the.

With tax season right around the corner many homeowners are wondering. IRS Tax Publication 503. Be eligible for the disability tax credit.

For an expense to be eligible as a medical expense you must. Can I write off my lease payments on taxes. Maybe youre not self-employed but you work for an agency or company.

4 Common Tax Deductions for Nurses Mid-wives and other Healthcare Professional. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Yes you can claim medical expenses on taxes.

Some items you can write off the whole cost while others will need to have your TS applied. The deduction applies to you your spouse or a dependent you claim on your tax return. Either way youre able to minimize the expenses of book purchases on your taxes.

Furniture Appliances Furniture and appliance purchases can be written off as home daycare tax deductions. The individual receiving the care must be chronically ill. Lets look at them.

Now that you know if and what you can deduct as a caregiver and for home care expenses it is only a matter of actually doing your taxes. Can I write off the costs of my expensive bathroom remodel patio addition or kitchen upgrade. Yes in certain instances nursing home expenses are deductible medical expenses.

If that individual is in a home primarily for non-medical reasons then. For long-term home care to be tax deductible three requirements generally need to be met. Can You Write Off Medical Expenses.

The care must be of a type approved by the IRS to be tax deductible. There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your. Have a written certification from a medical practitioner that states the services are necessary.

Be sure to use a licensed professional if you have any question about deductions and to be sure you are properly qualified. If you have to lay out cash of your own to cover home health care expenses some of the total cost could be deductible on your federal income tax. Certain home improvements are tax deductible and can be utilized to reduce the amount of tax you pay to Uncle Sam.

But not everyone will. Medical and Dental Expenses. Home care workers and employment taxes.

If your lease is 400 a month and you use it 50 percent for business you may deduct 2400 200 x 12 months. If you are receiving attendant care services in your home you can only claim for the period when you are at home and need care or help. Any furniture or appliance that you use in the daycare and for personal use needs to have the TS applied.

For tax year 2020 the IRS permits you to deduct the portion of your medical expenses that exceeds 75 of your adjusted gross income or AGI. For home health care workers who work for an agencycompany. Car Travel for Business.

There are both tax credits and deductions that can be taken when the purchase was made or afterwards. If you use your home as a primary location for your trade or business your primary location for meeting patients or clients as the storage place for inventory or product samples rental use or a daycare facility you can write off part of your home expenses. Hair care and haircuts Similar to makeup costs hair care expenses only qualify as a tax deduction when they are specifically for work-related photo shoots or shows.

The care must be prescribed by a licensed health care professional. If this applies to your in-home attendant and if you pay Medicare tax state employment tax social security tax or state or federal unemployment tax on their behalf these costs may qualify as a medical expense deduction. For example scrubs lab coats or medical shoes are items you can write off when doing your taxes.

Writing Off In-Home Care Taxes The IRS does allow medical tax deductions for what it defines as medical expenses in Publication 502. The maximum you might receive is. You can deduct the business portion of your lease payments.

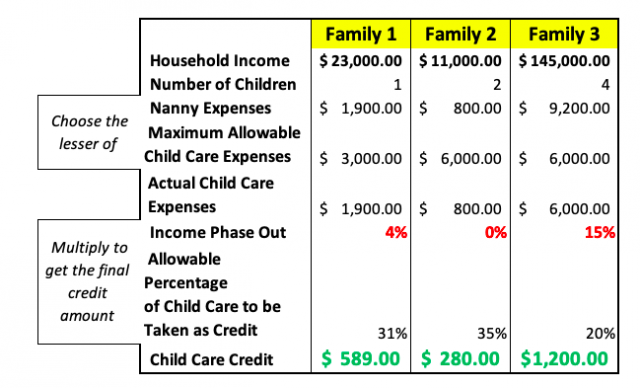

You can claim up to 3000 of your expenses but the amount of the credit is based on a percentage of your expenses and depends on your adjusted gross income. Fortunately it is possible to write off long-term senior care expenses including in-home care as a tax deduction.

Publication 503 2020 Child And Dependent Care Expenses Internal Revenue Service

Can I Deduct Nanny Expenses On My Tax Return Taxhub

9 Amazing 1099 Independent Contractor Tax Deductions Next Insurance

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

:max_bytes(150000):strip_icc()/2441-b1862b33c9114ea490a73925cb0252d7.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Child And Dependent Care Credit Definition

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

How To Deduct Home Care Expenses On My Taxes

Can I Deduct My Medical Expenses Seymour Perry Llc

What Portion Of In Home Caregiver Expenses Is Deductible As A Medical Expense

Posting Komentar untuk "Can I Write Off Home Care Expenses On My Taxes"