Claim For Working From Home Covid 19

If two or more of you live in the same property youre all required to work from home and its fair to say that costs have increased specifically from each individual working from home you can all claim it. However employers may not want you to keep all your leave until later in the year.

If You Run A Business From Home You Could Qualify For Home Office Deductions Johnson Block Cpas Madison Wi

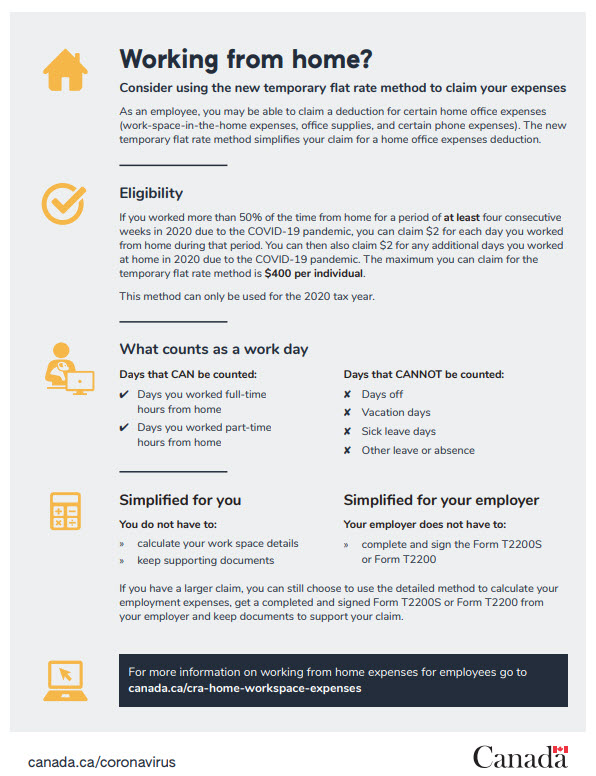

You can claim 2 for each day you worked from home during that period plus any additional days you worked at home in 2020 due to the COVID-19 pandemic.

Claim for working from home covid 19. So if youve had an increase in costs because youre required to work from home you can claim it. Did you make a claim before October 2020. This could be a diary or a timesheet.

You cannot claim for anything else. The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual. This amount is a tax deduction and not a credit which means you deduct it from your income to reduce your.

CRA allows all employees who worked from home during the COVID-19 pandemic in 2020 to claim up to 400 in employment expenses as a flat rate. Employees who have been advised to work from home during the COVID-19 outbreak are eligible to claim tax relief for heating and lighting the room that they work in and for the costs of business telephone calls. The working for home relief is 312 for the tax year.

You need to keep a record of how many hours you work from home. Using a home office often means that you have extra expenses every month. The working-from-home tax relief is an individual benefit.

This is to cover all your extra costs of working from home. Employees can claim allowance for working from home. You can only claim for the days that you work from home.

You can claim 080 for every hour you worked from home. The Association of British Insurers ABI provides advice and guidance to support customers who may be working from home due to COVID-19. Employees preparing to return to the office following the Covid-19 lockdown are being reminded they are still in time to claim tax relief if they have been working from home.

Below we discuss what expenses qualify and how you can claim. Things you bought like a desk your higher bills like electricity or phone. You may be able to claim tax relief for.

This increase was announced at Budget. Those who work at home on a voluntary ad-hoc basis would be ineligible to claim. This applies for the duration of the COVID-19 pandemic.

Coronavirus Covid-19 claiming home-working expenses. For 20192020 it was 4 a week you can go back on your tax return for 20192020 and make an amendment if you done the return online yourself. Normally claims for tax relief for unreimbursed home-working expenses would only be eligible for tax relief from HMRC if a staff member worked from home on a regular basis under a formal arrangement agreed by the University ie.

Annual leave during COVID-19 You continue to build up your annual leave when you are working from home and working your usual hours. Posted about a month ago by Filipe Maziero. Employers may find it beneficial to check the HMRC guidance on working from home allowances to check which expenses can be paid without incurring a tax liability in relation to who are working from home due to coronavirus.

Employees required to work from home can have a 6 per week or 26 per month allowance paid tax-free by employers or during the pandemic can claim a deduction. The good news is that the South African Revenue Service SARS will let you claim tax back on these costs. The COVID-19 pandemic lockdown has led to many South Africans working from home.

You cannot claim tax relief if you choose to work from home. This includes if you have to work from home because of coronavirus COVID-19. Coronavirus homeworking and how to claim money back on your electricity bill If youve been asked to work from home due to the Covid-19 outbreak you may be able to claim.

If your employer pays you an allowance towards your expenses the amount paid is deducted from the amount you can claim back from Revenue. You may not want to take annual leave during the COVID-19 restrictions as your travel options are limited. They can claim a fixed amount of 4 per week up to 5 April 2020 then 6 per week thereafter.

This does not include times you may have brought work home to do outside your normal working hours.

Coronavirus Tax Tips For Working From Home Money The Sunday Times

2020 Income Tax What You Can T And Can Claim For Your Work From Home Office During The Covid 19 Pandemic Moneysense

Working From Home During Covid 19 These Accountants Have Tax Tips Cbc News

Hmrc If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On Gov Uk Check If You Re Eligible

Covid 19 Expenses When Working From Home Lighter Hr

Hmrc If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On Gov Uk Check If You Re Eligible

I Work Remotely During Covid 19 Can I Take A Home Office Tax Deduction Rkl Llp

Claiming Working From Home Tax Expenses During Covid 19

Working From Home 2020 Tax Information University Of Victoria

Working From Home Tax Deductions Covid 19

Posting Komentar untuk "Claim For Working From Home Covid 19"