Can I Write Off Home Improvements On My Taxes

These costs are nondeductible personal expenses. The Internal Revenue Service allows business owners to write off.

Tax Differences Between Home Repairs Home Improvements Don T Mess With Taxes

While adding a kitchen or addition is an.

Can i write off home improvements on my taxes. One way you can cleverly deduct your home improvement budget is to roll it into your mortgage when you purchase a house. They can help reduce the amount of taxes you have to pay when you sell your home at a profit. If you bought your vacation home exclusively for personal enjoyment you can generally deduct your mortgage interest and real estate taxes as you would on a primary residence.

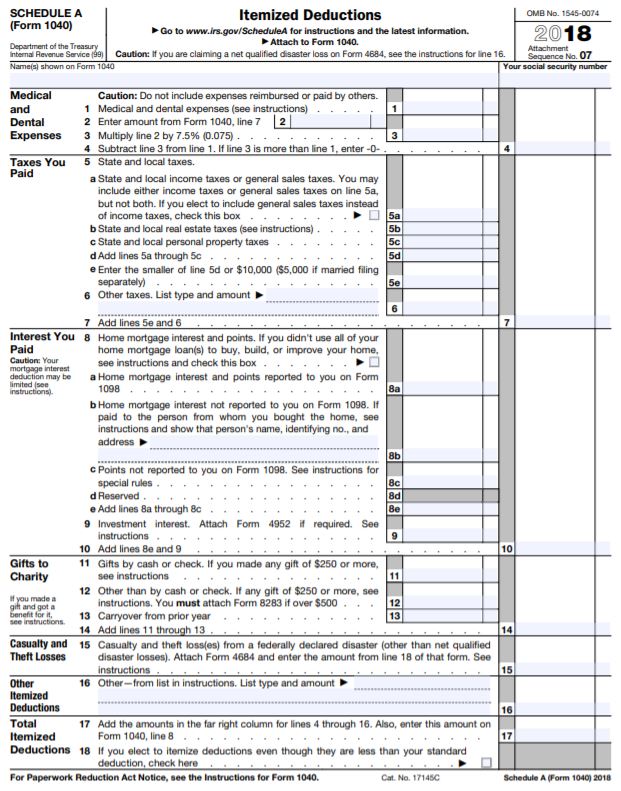

Home Renters Improvement Tax Deduction. Use Schedule A to take the deductions. When it comes to your personal residence or a vacation home that you use for personal purposes the expenses you pay for routine home repairs and maintenance are considered personal nondeductible.

For example if you decide to add a bathroom to the rental space you likely can write off 100 of that expense. Home improvements can help you save money on taxes when you sell Although garden-variety home improvements wont score you a tax deduction right now they could be helpful in reducing taxes. Capital improvements can save you from paying more in capital gains when the time comes to sell your home.

The entire cost of a repair is deductible in a single year while the cost of an improvement to the rental property may have to be depreciated over as much as 275 years. Improvements you make to your homes structure such as remodeling a kitchen or replacing a roof do add value to your home and the expenses are treated differently for tax purposes. If you do so when you sell the house you cant exclude the amount of depreciation you took under the.

Considering that you probably spent most of 2020 primarily working from home this is a deduction that should be a priority. Usually you cant expect to deduct anything from your Federal tax return just because you decided to make changes to your home. The cost of installing entrance or exit ramps modifying bathrooms lowering cabinets widening doors and hallways and adding handrails among others are home improvements that can be deducted as medical expenses.

However your deduction for state and. Can I deduct home improvements on my tax return. If you use your home purely as your personal residence you cannot deduct the cost of home improvements.

As such you may be able to write off costs like rent mortgage interest utilities real estate taxes repairs or inventory. Writing off the Home Office for a personal business will give you a greater deduction for tax purposes than as an Employee Business Expense. While you cant write off home improvements as an item on your income tax return certain home renovations will qualify as capital improvements.

But certain home-improvements are tax deductible and can be utilized to reduce the amount of tax you pay to Uncle Sam. How Can You Write Off Improvements on a Ranch Like Fencing Land Clearing. Since Employee Business Expenses are no longer deductible on the Federal then you need to see about the advantage it may give you on your.

As far as taxes go repairs to a rental property are always better than improvements. That tax break no longer exists. Home office expenses.

A repair is any modification that restores a home to its original state andor value according to the IRS. However this doesnt mean that home improvements do not have a tax benefit. If you operate a business from your home or rent a portion of your home to someone you may be able to write off part of your homes adjusted basis through depreciation.

If you rent out a part of your home you may be able to deduct in full any improvements you make to that space. Several types of home improvement projects can be eligible for a tax write-off but it ultimately comes down to what kind of remodel youre completing and whether its classified as a repair or an improvement. SOLVED by TurboTax 3006 Updated 7 days ago.

On your personal residence the answer is usually no although you might qualify for certain kinds of energy-related home improvements. If your upgrade could be classified as a repair and you have a home office you can write off the proportional share of the cost as a home-office expense. As we said home improvements cant be written off like say tax preparation fees or medical expenses although later well see how medical expenses might lead to home improvement deductions.

Improvements to your home can also be deducted from your income as medical expenses if they are medically necessary.

10 Tax Deductions For Home Improvements Howstuffworks

Tax Deductible Home Improvements For 2021 Budget Dumpster

Tax Breaks For Capital Improvements On Your Home Houselogic

7 Home Improvement Tax Deductions Infographic

Tax Deductible Home Improvements For 2021 Budget Dumpster

Are Home Improvements Tax Deductible It Depends On Their Purpose

Tax Deductible Home Improvements For 2021 Budget Dumpster

Here Are 5 Expenses You Can Write Off When Selling A House

Are Property Taxes Deductible Guide Millionacres

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

Posting Komentar untuk "Can I Write Off Home Improvements On My Taxes"