Can I Write Off A Second Home On My Taxes

Your RV can be written off. So your boat will be your second home unless you only have a boat and an RV.

Buying A Second Home Is It Right For You Ramseysolutions Com

This is part of the new Tax Cuts and Jobs Act and these numbers are down from the prior limits of 1 million or 500000 for a married taxpayer filing a separate return.

Can i write off a second home on my taxes. While you cant write off home improvements as an item on your income tax return certain home renovations will qualify as capital improvements Capital improvements can save you from paying more in capital gains when the time comes to sell your home. A houseboat is just that a houseboat and can be. Yes for federal tax purposes an RV can be claimed as a primary residence or second home.

Unfortunately this is capped at a total deduction of 10000 per year. You can deduct the mortgage interest on the second home just as you would with your first home. Both sets of property taxes are eligible to be deducted on federal.

The buy build or improve is the key here. The limits apply to the combined amount of loans used to buy build or substantially improve the taxpayers main home and second home. Diverse types of residences qualify for the deduction.

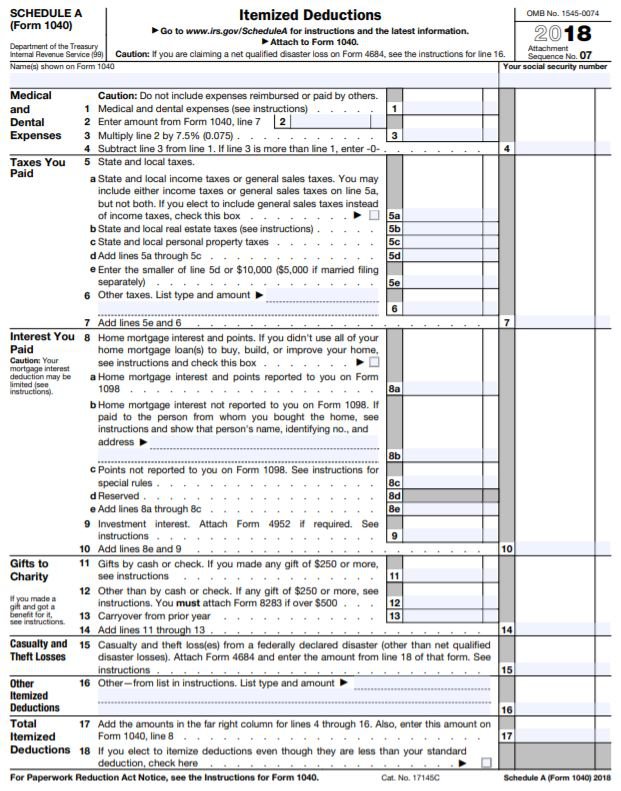

If you itemize you can write off the mortgage interest you pay on up to 750000 of debt secured by both your first and second homes. But you may not be able to deduct those property taxes on your second home depending on how much property tax you already pay. Some of the tax issues involved can be complicated and will likely require the guidance of a tax.

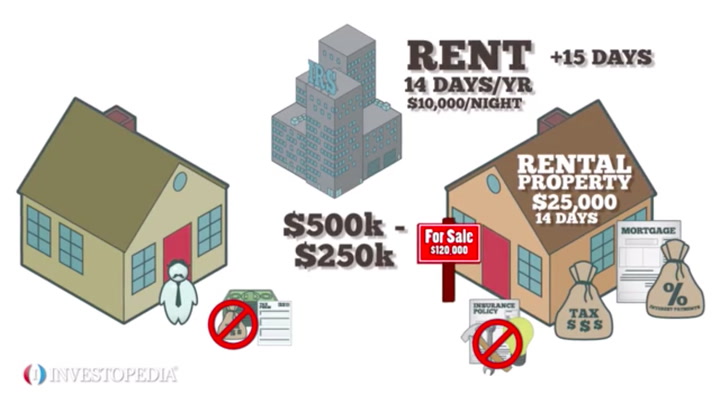

How many and what kind depends on whether you also rent it. If you rent your second home you could be taxed on your rental income either as a landlord Schedule E or as a self-employed person Schedule C. For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or improve the properties.

If your home or second home is not in the United States you can still get US. You might refinance or sell the home before you pay off the mortgage. If you itemize deductions you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home.

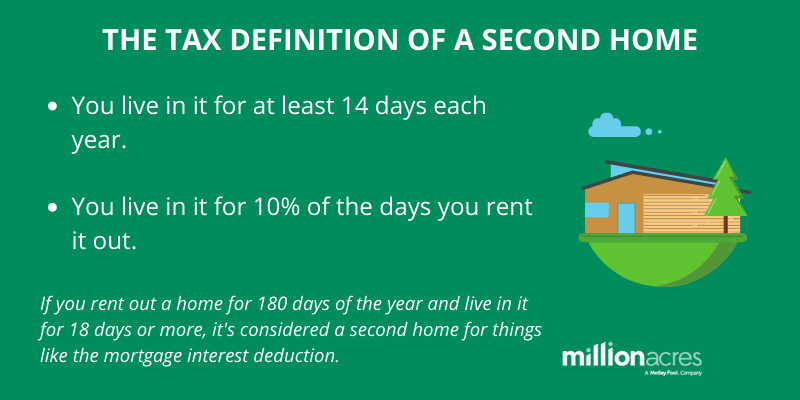

If your second house was purchased before December 15 2017 is used primarily for personal use and isnt a rental or business property then the answer is yes. Renting your second home. This allows you to take advantage of the same tax deductions as a typical homeowner.

That tax break no longer exists. Thats why many convert their homes to rental properties prior to selling although that really is not wise when you realize the basis on conversion rules. But you can only write-off two homes.

If if is truly a personal residence which means that you rent it out fewer than 14 days a year you can write. If you itemize deductions on your tax return you can write-off the interest on mortgages on two homes. Mortgage interest is tax-deductible up to a certain point for a second home.

If so you can deduct points in the year of sale or refinance points you didnt previously deduct. This amount is 1 million if your mortgage loans are grandfathered ie were in existence as of December 15 2017. Real estate taxes paid on the property are also typically deductible.

For a second home you can deduct property taxes on your tax return as part of the state and local taxes deduction also known as the SALT deduction. Can I deduct the loss on the sale of a second home. Thats a total of 11 million of debt not 11 million on each home The rules that apply if you rent out the place are discussed later.

Can I write off an RV as a business expense. You must report rent you receive as income which is taxable. If you reside or stay at the property during the year and rent it out for 14 days or fewer you dont have to report your rental income to the.

Generally a loss on the sale of your main home or vacation home cannot be deducted as its considered personal. That includes property taxes you pay on your primary residence and any state and local income taxes you pay. Up to 100 of interest paid on up to 750000 of debt can be written off on your taxes.

However the way that you use your second home will determine how you write it off.

Are Property Taxes Deductible Guide Millionacres

Tax Breaks For Second Home Owners

Second Home Tax Tips What Most People Don T Realize

/cabin-5bfc37f1c9e77c0051831f7e.jpg)

Tax Breaks For Second Home Owners

Tax Deductions For Second Homes

Here S What Owning A Second Home Means For Your Taxes

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Publication 936 2020 Home Mortgage Interest Deduction Internal Revenue Service

How A Second Home Affects Taxes Nationwide

What Is A Second Home Millionacres

Posting Komentar untuk "Can I Write Off A Second Home On My Taxes"